John Hancock said in testimony before a House Committee today that the recent premium increase for the Federal Long Term Care Insurance Program (FLTCIP) was necessary to keep the Experience Fund from running out of money.

Rationale for the Premium Increase

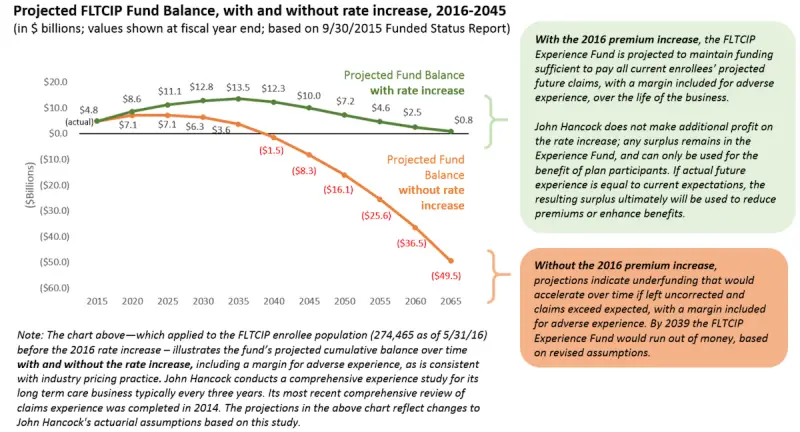

According to written testimony, Michael Doughty, President and General Manager of John Hancock, said that after conducting an actuarial analysis in May 2014 and discussing the findings with OPM, it was decided a premium increase was necessary to prevent a funding shortfall reflecting results of projected liabilities exceeding projected assets. Based on the analysis, without the 2016 premium increase, projections indicated that the program’s Experience Fund would have run out of funds by 2039.

Because of the increase, however, the Experience Fund is projected to maintain funding sufficient to pay all current enrollees’ projected future claims, including a margin for adverse experience.

This statement from John Hancock’s testimony captures the essence of the situation:

John Hancock cannot guarantee that rates will not have to be increased in the future. As is the case for all long term care insurance — not just the Federal Long Term Care Insurance Program — John Hancock is required to price using assumptions that will result in premiums that are sufficient, along with a reasonable margin to absorb the impact of moderately adverse (i.e., moderately worse than expected) claims experience. This pricing is intended to cover all claims for existing enrollees, unless the underlying assumptions change and an adjustment to the premiums becomes necessary. The Federal Long Term Care Insurance Program needed a rate increase when the actuaries determined, in mid-2014, that the rates were not adequate based on new data and emerging claims trends. The revised assumptions were reviewed by independent actuarial firms. Both John Hancock and the Office of Personnel Management have a contractual responsibility to adjust current premiums where necessary to achieve overall program funding sufficiency.

The chart below shows why the premium increase was necessary to sustain the funds for claims under FLTCIP.

John Hancock also noted in its testimony that the company does not make additional profit on the premium rate increase amount. Any surplus remains in the Experience Fund and can only be used for the benefit of plan participants. If actual future experience after the 2016 rate increase is equal to or better than current expectations, the resulting surplus ultimately could be used to reduce premiums of enrollees, or to enhance their benefits.

The company acknowledged the “budgetary strain” that the premium increases would no doubt create for affected federal employees. With respect to this, the testimony covered ways that John Hancock and OPM worked to offset some of the financial burden for enrollees, notably, that a personalized package of options was mailed to each affected participant with the following:

- Enrollees could choose a “premium neutral option” to fully offset the premium increase (in some cases, this option may substantially reduce the rate of future inflation protection growth or benefits).

- Enrollees could choose a partial increase, accepting roughly half the premium increase along with moderate benefit package reductions.

- Enrollees could accept the full increase and retain current benefits and inflation protection.

- Enrollees could cease premium payments and receive a limited “paid-up” policy with a greatly reduced lifetime maximum benefit (available only to enrollees whose premium has increased beyond a certain percentage based on the age of the person as of the date the policy was issued).

What is the Experience Fund?

The legislation creating the Federal Long Term Care Insurance Program requires the insurance providers to account for all premiums received for the FLTCIP — and to track investment returns — separately from all other funds.

John Hancock maintains a separate account for the Federal Long Term Care Insurance Program, known as the Experience Fund, that is used exclusively for the program’s assets and liabilities.

Pursuant to the statute, the Experience Fund receives all premiums collected and investment income earned. This funding approach allows for a seamless transition to a successor carrier, as was the case in 2009, when the MetLife/John Hancock consortium ended and John Hancock became the sole successor carrier. The statute also requires that enrollees pay the entire premium for the coverage, so that no taxpayer dollars subsidize enrollee premiums.

NARFE’s president Richard G. Thissen also offered testimony at the hearing. For details on NARFE’s position and recommendations, see NARFE President Testifies on Federal Long Term Care Insurance Program Premium Increases.