Although they were practically a footnote, the same benefit cuts we’ve heard about before were resurrected in the latest budget proposal from the White House.

If you experienced deja vu, it’s because most of them have been in at least the last two budget proposals in nearly identical form. You can read in depth about the 2019 and 2018 budget proposals in the links included at the end of this article.

More information is reportedly forthcoming on the latest proposed benefits reductions, but here is a recap from past proposals that likely is still accurate given the similarity in the proposals.

Proposed Benefits Cuts from the 2020 Budget Blueprint

Eliminate COLAs

Cost of living adjustments would be eliminated for retirees under the Federal Employees Retirement System (FERS) and reduce them by 0.5% for retired federal employees under the Civil Service Retirement System (CSRS).

Past budget proposals said that this change would bring the federal government’s “very generous package of retirement benefits” more in line with those of the private sector which has largely eliminated pensions.

Raise Employee Portion of FERS Retirement Contributions

This proposal would increase the employee share of contributions to federal employees under FERS by raising the employee’s share of contributions to 50% of the cost.

In last year’s budget proposal, it recommended phasing it in over several years to mitigate the impact and also said that for certain categories of federal employees, such as law enforcement and firefighting, employee contributions would increase, but the government would continue to pay a higher share of the normal cost.

Changing the Government’s FEHB Contribution Rates

Last year’s budget proposal suggested changing the government contribution under FEHB to between 65-75% depending on a plan’s performance to encourage enrollment in high-performing health plans by making them more affordable. Presumably, this year’s proposal would follow the same model.

Other Proposed Changes

- The FERS Special Retirement Supplement would be eliminated for those employees who retire before Social Security eligibility age.

- Annuities would be calculated based on a “high-5” instead of a “high-3” as is done currently.

- The G Fund interest rate would be reduced to base the yield on a short-term T-bill rate instead of the current rate (an average of medium and long term Treasury bond rates).

Will These Become Reality?

Highly unlikely. The same suggestions to cut benefits were in the last two budget proposals and have not come to fruition. They have an even lesser chance of passing in the current session of Congress now that Democrats control the House.

To the extent you may be worried, remember that these budget blueprints are proposals only, and Congress must ultimately set agency budgets and make new laws. This is a slow process and involves many parties, each with their own interests.

I am Worried; What Can I Do?

The downside of leaving another party in charge of your retirement is that it may not have the kind of outcome you had hoped for as these proposed benefits cuts prove. Pensions have virtually disappeared in the private sector, and now the government is slowly following suit, first by doing away with CSRS and now gradually imposing and suggesting reductions to FERS. These types of cuts may or may not come to fruition in the long run, but it understandably has federal employees worried.

Consequently, one of the best things federal employees can do is focus on the parts of their retirement that are within their control.

Thrift Savings Plan

Are you contributing to the TSP? If not, you should be.

Under FERS, the government matches against the first 5% of pay that you contribute every pay period. The first 3% is matched dollar-for-dollar by your agency or service; the next 2% is matched at 50 cents on the dollar.

This means that when you contribute at least 5% of your basic pay, you take full advantage of this match which amounts to free money going towards your retirement. Your agency or service contributes an amount equal to 4% of your basic pay to your TSP account; combined with the agency/service automatic 1% contribution you get, your agency/service puts in a total of 5%.

Combine this match with the returns from a long-term investment in the TSP’s stock funds and you can easily be a millionaire at the end of your federal career, and the best part is, it’s your money!

Roth IRA

You can also save even more towards your retirement on your own by setting up a Roth IRA. You contribute money after taxes and it grows tax-free, meaning when you reach retirement age and withdraw the money, you do not pay taxes on it again unlike in a traditional IRA.

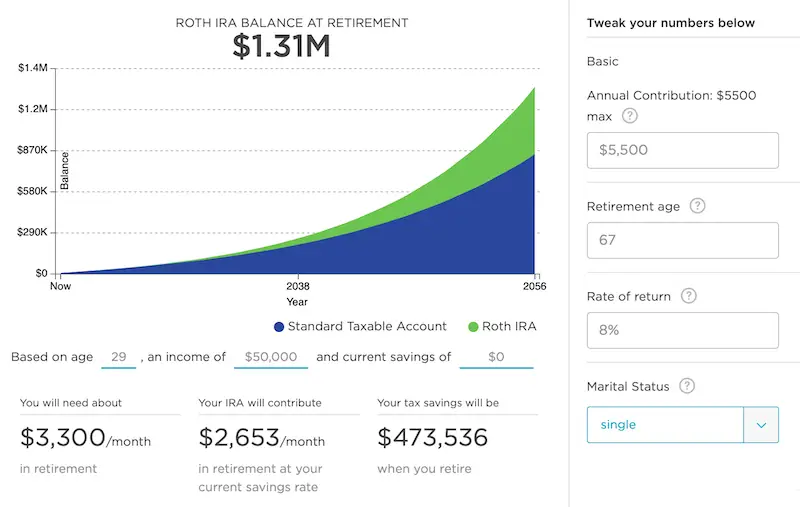

This can add up to huge tax savings. There are various calculators online that show you just how much these savings can be.

The computation below is one example from Nerd Wallet – it assumes a person starts investing in a Roth at age 29 with a zero balance and maxes out the contribution each year. By age 67, the account is worth $1.31 million based on an average 8% return and has just over $473,000 in tax savings by being in a Roth IRA instead of a traditional IRA. The reason the tax savings become so significant is because most of the money in the account is from growth of the investments rather than the money the individual contributes; by being in a Roth, the growth is tax-free, whereas, in a traditional IRA, you have to pay taxes on all of that growth when you take the money out at retirement.

These are some basic ideas to get you started, but be sure to get in touch with a qualified financial advisor, especially if you find all of this daunting or do not know where to begin. He or she can work with you to develop a comprehensive plan for your retirement that incorporates all aspects of your federal employment benefits to ensure you have adequate finances to cover your needs once you reach your golden years.