Most TSP Funds Up So Far in March

In February, those who follow their Thrift Savings Plan (TSP) investments closely will recall that the C Fund went down almost 3% in February and it was down just over 8% for the year at the end of the month.

After several weeks in March, how is the C Fund performing now?

The C Fund is up 1.98% so far in March. For the year-to-date, the C Fund is down 6.18%—an improvement of being down about 8% at the end of February. Unfortunately, the S Fund is down 0.28% so far for the month and is down -10.30% so far in 2022. At the end of February, it was down 10.05% for the year-to-date.

F Fund, I Fund and S Fund Losses Increasing in March

For most of the TSP Funds, including the Lifecycle Funds, the year-to-date losses are now less than they were at the end of February. The biggest exception is the F Fund which is now down 5.68% for the year. At the end of February, it was down 3.15%. At the end of February, the I Fund was down 6.47% for the year and it is now down 7.27%.

And, at the end of February, the G Fund was up 0.28%. As of March 23rd, it was up 0.40% so far for the month of March.

TSP YTD Fund Rates of Return as of March 23, 2022

As of the close of the market on March 23, 2022, here are the year-to-date returns for all of the TSP Funds:

| FUND | PRICE | Year-to-Date | YTD Return 2/28/22 |

|---|---|---|---|

| G Fund | $16.8035 | 0.40% | 0.28% |

| F Fund | $19.6995 | -5.68% | 3.15% |

| C Fund | $67.4995 | -6.18% | 8.01% |

| S Fund | $74.8474 | -10.30% | 10.05% |

| I Fund | $36.5743 | -7.27% | 6.47% |

| L Income | $23.1056 | -1.62% | -1.79% |

| L 2025 | $11.8710 | -3.07% | -3.36 |

| L 2030 | $41.6703 | -4.37% | -4.73% |

| L 2035 | $12.4854 | -4.86% | -5.23% |

| L 2040 | $47.1494 | -5.32% | -5.70% |

| L 2045 | $12.8869 | -5.75% | -6.12% |

| L 2050 | $28.1846 | -6.13% | -6.52% |

| L 2055 | $13.8335 | -7.05% | -7.67% |

| L 2060 | $13.8328 | -7.05% | -7.67% |

| L 2065 | $13.8322 | -7.05% | -7.67% |

TSP Interfund Transfers in February

In February, more than $7.6 billion was transferred into the G Fund by TSP participants. Here is how TSP investors transferring funds reacted in March:

- $3.67 billion from C Fund

- $2.2 billion from S Fund

- $1.2 billion from L Funds

- $337 million from I Fund

At the monthly TSP meeting held on March 24th, 2022, a TSP official pointed out the money being transferred in the TSP was only about 2.2% of total TSP plan assets. In other words, while $7.6 billion transferring to the G Fund is a large amount of money, it is still a small percentage of more than $769 billion of the TSP’s plan balance.

C Fund Still Most Popular in the TSP

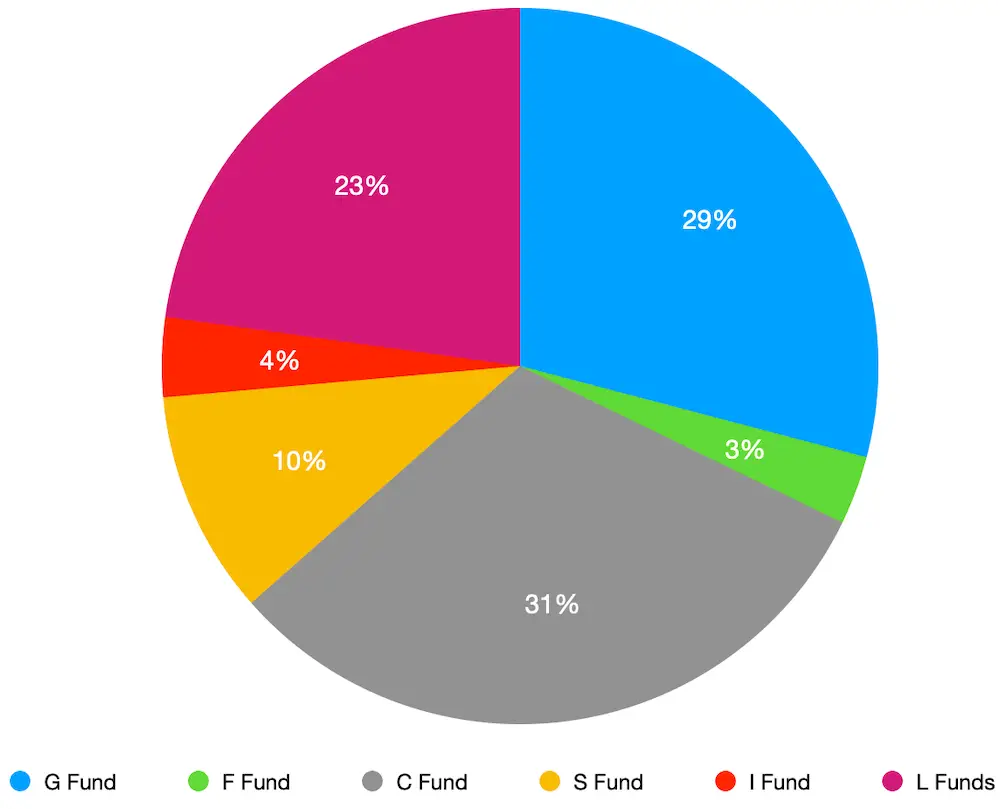

With the $7.6 billion transferred in February, the percentage of assets by TSP participants in the G Fund has increased. As of the end of February, here is a list of the TSP asset allocation by TSP participants:

- 31.3%: C Fund

- 29.1%: G Fund

- 22.8%: L Funds

- 10.1%: S Fund

- 3.6%: I Fund

- 3.1%: F Fund

Status of New Nominees to FRTIB and Russian Investments in the TSP

In August 2021, President Biden nominated new members to be on the Federal Retirement Thrift Investment Board (FRTIB)—the organization that oversees the TSP.

President Trump had previously nominated three FRTIB members shortly before leaving office, but President Biden pulled those nominations quickly after his inauguration.

During the Trump administration, a controversy emerged surrounding the nominations because of the FRTIB’s decision to change the underlying index tracked by the I Fund to another one. The FRTIB was moving out to invest more heavily in some foreign companies, including Chinese and Russian companies. The planned change to the I Fund was ultimately delayed.

As noted in Politics, Russia’s Invasion of Ukraine, and Your TSP, and as restated by Kim Weaver, Director of External Affairs for the Federal Retirement Thrift Investment Board in the March 24th meeting of the FRTIB, the TSP does not have any investments in Russian companies.

Also at the March 24th meeting, Ms. Weaver announced a “mark-up” meeting has been scheduled for March 30 on the FRTIB nominees.

A mark-up session is one held after hearings are completed and a bill is considered in a session called a “mark-up” session. This is when members of the committee study the viewpoints presented. A Senate vote will be held at some time after the mark-up session is held.

TSP Monthly Rates of Return for March

The monthly, year-to-date, and 12-month performance of each TSP Fund will be published by FedSmith on April 1, 2022.