TSP performance has improved so far in July 2022 after what has been a rough year for the stock market with a bear market setting in during the first half of the year.

The FRTIB has also provided an update on the new TSP website in its latest monthly meeting and the resulting problems that some TSP participants experienced, such as unusually long wait times when contacting TSP customer support, after the rollout of various new features and TSP website changes at the beginning of June.

Update on New TSP Website

In the Federal Retirement Thrift Investment Board (FRTIB) meeting held on July 26, 2022, Tee Ramos from the Office of Participant Services summarized the results of the first month of the new TSP website since it went into effect.

A number of FedSmith readers have commented on problems stemming from the launch of the new TSP website at the start of June 2022 including setting up accounts under the new system and long hold times with the TSP contact centers. While the system is improving as more people are added to the contact center staffing, it is unlikely the system will return to more normal operations until mid or late August.

The TSP has been experiencing a very large increase in traffic and TSP activity since the new website and features were implemented. Here are data from FRTIB on the difference between 2021 and 2022:

| June 2022 | June 2021 | |

| Loans | 43,278 | 22,917 |

| Withdrawals | 318,224 | 266,827 |

| Contact Center Calls | ~908,000 | ~181,000 |

The increase in transactions was likely due to increased demand after the black-out period just before the new TSP website was implemented. There has also been increased interest from TSP participants in a 2nd general purpose loan.

More than 1.1 million accounts were set up in June. Most of these transactions were done through the web, the TSP mobile application, and the chat feature.

Through June, 1,967 loans per day were processed. The comparable figure in 2021 was 1,000 loans per day. The Contact Centers averaged 34,000 calls per day. The average number per day in 2021 was 9,000 calls. 40% of the total calls received in 2022 were received in June.

TSP Performance Positive So Far in July

Here are the results for the core funds in the TSP for the month of July through July 25th and for the year-to-date.

The C Fund has declined in value in five of the last six months, and the S Fund has declined in four of the last six months. As the data below indicate, the performance of the TSP’s core funds all show a positive return so far in July 2022, although they are still showing a decline so far year-to-date in 2022.

| TSP Fund | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.21% | 1.36% |

| F Fund | 1.53% | -8.71% |

| C Fund | 4.87% | -16.06% |

| S Fund | 6.44% | -23.28% |

| I Fund | 2.34% | -17.05% |

2022 Inflation and Rising Interest Rates

As inflation continues to go up in the latest published inflation data from the Bureau of Labor Statistics, stock prices have been volatile. The Federal Reserve is expected to raise interest rates another 0.75% in an effort to bring down inflation. Inflation is now at a four-decade high.

The result is that the Federal Reserve has raised interest rates three times this year starting with a quarter-point increase in March. This was followed by a half-point rise in May and an increase of 0.75-point in June. The June increase was the largest interest rate increase since 1994 and reflects the concern about the continuing inflation increase and its impact on the economy as many Americans are struggling to pay their bills with inflation resulting in rapid price increases.

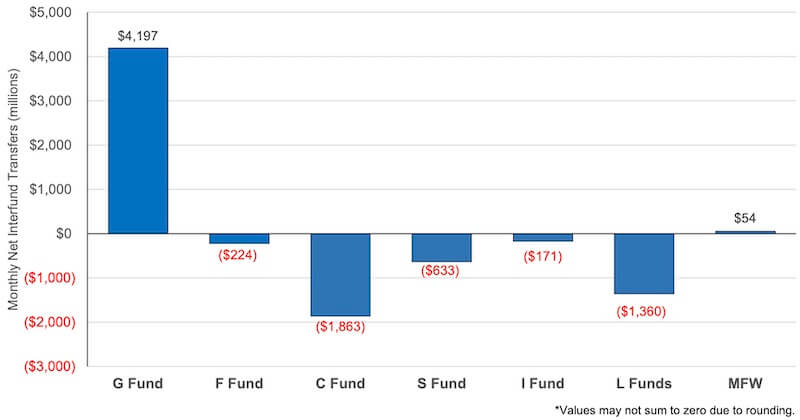

TSP Transfers into G Fund Continue in June

Last month, FedSmith reported an increase of 249% in funds transferred into the G Fund from April to May. At the same time, money leaving the C Fund went from $17 million in April to $3.49 billion in May.

This same trend continued in June. Another $4.1 billion was transferred into the G Fund in June 2022. Withdrawals from the C Fund were about $1.8 billion, another $1.36 billion from the Lifecycle Funds, $633 million from the S Fund, and $17 million from the I Fund.

In two months, about $10.55 billion was transferred into the G Fund. This translates into an increase of 486% in monthly interfund transfers to the G Fund from the amount transferred in April. $10.55 billion is a great deal of money, but, looking at a broader picture, most TSP participants have not moved their investments.

At the end of April, total participant TSP assets in the G Fund were $223.4 billion. At the end of June, participant assets in the G Fund were $234.5 billion—an increase of $11.1 billion. $11.1 billion is a large amount of money. But, as a percentage of the participant assets in the G Fund, it is a relatively small percentage.

While there was a huge increase in the percentage of TSP investors’ money being transferred to the G Fund through interfund transfers in those two months, the total amount in the G Fund only increased by about 4.96%.

While the G Fund moved into place as the largest TSP Fund, and the C Fund has dropped into the second largest TSP Fund, the amount of money in the C Fund from participant allocations was $206.1 billion at the end of June.

At the end of December, the amount in the C Fund from participant allocations was $268.7 billion. From the end of December through the end of June, the C Fund total declined by $62.6 billion or about 23%.

As a result of the continuing decline in the value of stocks and the interfund transfers, the size of the G Fund has continued to grow and constitutes a larger share of total assets in the TSP. The G Fund now has more than 33% of assets from TSP participants while the C Fund, which used to be the largest Fund, now has just over 29% of participant allocation.

| Fund | % of Participant Total Assets December 2021 | Participant Allocation Share of Total Assets June 2022 | Total Participant Fund Assets December 2021 (Billions) | Total Participant TSP Fund Assets by Fund June 30, 2022 (Billions) |

| G | 26% | 33.2% | $210.9 | $234.5 |

| F | 3.1% | 2.9% | $24.9 | $20.8 |

| C | 33.1% | 29.2% | $268.7 | $206.1 |

| S | 11.2% | 8.8% | $91.2 | $62 |

| I | 3.8% | 3.4% | $30.7 | $23.7 |

At the end of June, total TSP assets were almost $707 billion ($706,851). At the end of December 2021, total TSP assets were almost $812 billion. The differential reflects the impact of the stock market decline so far in 2022.

Second Quarter TSP Statements and Beneficiary Information from TSP

TSP participants will receive their second quarter account activity in two statements. The first statement will cover April 1 to May 26, 2022. The second statement will cover from May 26 to June 30, 2022. The second statement was mailed in late July.

If a participant has enrolled in the TSP mutual fund window, a separate statement will be mailed that includes mutual fund window account activity for the account.

Some participants will see a notice about their beneficiary designation indicating the account does not have any designated beneficiaries. This may be the case even if the participant has previously completed a TSP form for a designation of beneficiary. The TSP has released this statement:

For a small number of participants, we did not transfer beneficiary information to our new system because it did not meet certain data quality standards. We encourage all participants to review and confirm beneficiary information. If you don’t submit your beneficiary designation online, we’ll refer to your most recent form TSP-3, if you submitted one previously. Otherwise, we’ll distribute your account according to the order of precedence required by law.

Summary

The FRTIB anticipates a return to normal in mid to late August as far as handling call center queries. There will probably also be a more typical number of other TSP activities as the new TSP website makes changes to correct problems and TSP investors become more adjusted to the new site features and changes.

Stock market volatility is likely to continue. Inflation may go down some next month but will not disappear right away, and stocks are likely to experience dramatic swings as we move closer to national elections in November.

It appears most TSP investors are remaining in place with their investments. The money going into the G Fund in the last two months is much higher than usual and the overall percentage of funds being moved into the safety of the G Fund is relatively stable. Nevertheless, the G Fund is now the Fund with the largest percentage of participant assets as a result of recent transfers into the G Fund.