The Federal Retirement Thrift Investment Board (FRTIB) provided an update today on the new TSP website changes that were launched in June.

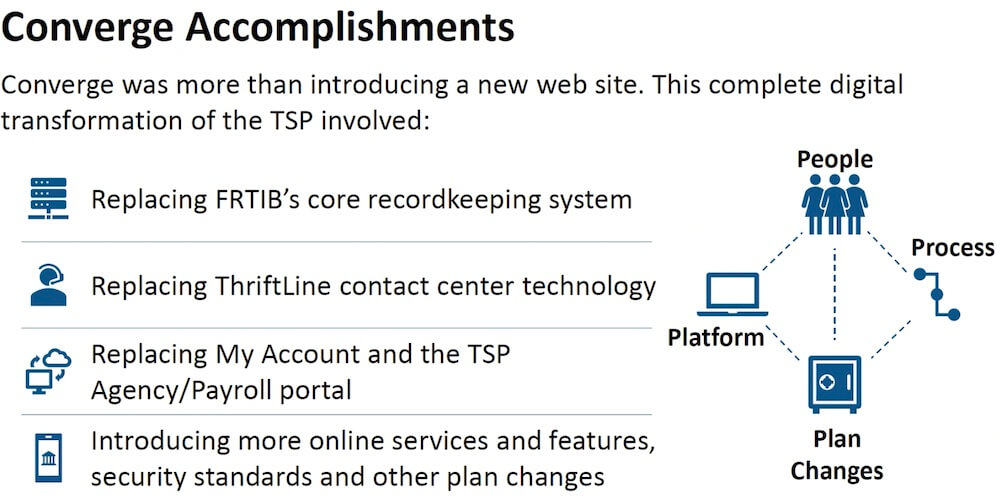

The changes that were made this year were much more than just revamping the TSP website. Known as Converge, the FRTIB said that it was a complete overhaul of what was an outdated and archaic system to move the whole TSP system into the 21st century.

Under the old system, it was harder to do things such as perform backups and have enough storage space whereas the new system is largely cloud based and scalable. For more details about the new system, see TSP Update: TSP Changes, Overcoming Obstacles and Status.

There were, of course, problems with the rollout. The FRTIB expected some problems, although some proved to be worse than others. Accenture Financial Services explained during a meeting in August that the more unexpected problems were primarily a result of a higher-than-expected call volume to the TSP’s customer support line as well as an overly cumbersome new account setup process.

Where Do Things Stand Now?

The FRTIB reported in its status update on October 27, 2022 of the Converge process that the problems that most plagued the rollout process in June are now largely back to normal.

ThriftLine Call Wait Times

Calls to the TSP’s customer support line (ThriftLine) are now answered on average within 19 seconds. When the call volume spiked shortly after the launch of the new TSP website, hold times were sometimes hours.

TSP Account/Beneficiary Problems

One common complaint raised by TSP participants was problems related to the individuals’ accounts or beneficiaries.

The FRTIB said that it received over a dozen concerns from TSP participants regarding account accuracy and fund allocation. It said that every reported case of an inaccurately converted account balance ended up being unfounded.

Some people said that their account beneficiaries were lost after the blackout. According to the FRTIB, no account beneficiary data were lost during the transition process. The agency provided these data:

- 4.8 million leverage “order of preference” (no beneficiaries on file)

- 1.4 million accounts had beneficiary information on file and none were lost

- 1.24 million accounts were converted electronically into the new system

- 157,000 beneficiary accounts were not converted electronically and the TSP-3 forms remain on file

Account Registration Problems

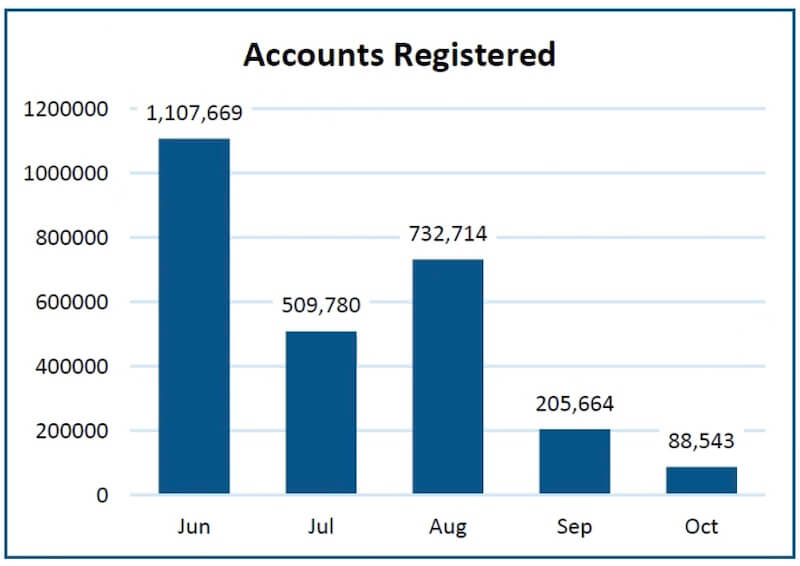

A common complaint about the Converge rollout was that there were problems with TSP account registration. The FRTIB reported that over 90% of all registration attempts have been completed online and 2.64 million TSP participants have successfully set up their accounts. The majority of online accounts were set up in June, the first month that the new TSP website was online.

TSP Mutual Fund Window

The adoption rate of the TSP mutual fund window has been low relative to the size of the TSP as a whole, but the FRTIB said that the participation rate since it was rolled out this year is in line with its expectations. It had expected a usage of 1-2% of TSP participants over the next several years. As of October 2022, there are 2,185 Mutual Fund Window accounts.

Problems with Withdrawals

One question raised during the meeting was in regard to TSP withdrawals not being processed on the date expected and it created concerns from the people not getting the money when expected. The person asking the question wondered if there was a way to deliver the money on an earlier date.

The FRTIB said it had heard similar concerns but noted that the underlying process for disbursements has not changed – the FRTIB has to sell the holdings to make the payment; FRTIB sends the information to Treasury who then either moves the direct deposit or issues a check and that process has not changed. It used to be done earlier in the month and it changed to the 15th of the month and people now seem to be noticing it more since the date has moved.

Older Statements Are Gone

Another question that came up during the meeting was in regards to historical account statements prior to the transition. The person asked if this problem would be corrected.

The FRTIB explained that these are not there because the decision was made to not move the older statements over to the new system because of how few people generally access them. They may consider putting some of the older ones on in the future, but there are no plans to put all 20+ years worth of old records into the new system. TSP participants who want older records can request them to get copies.

Are TSP Participants Using the New Features?

Data shared by the FRTIB indicate that the new features that were part of Converge are being utilized heavily. 90%+ of all interactions are happening via digital self-service channels:

- My Account logins: 19,188,840

- Mobile app downloads: 418,754

- AVA sessions: 775,671

- Live chat sessions: 19,603

- Email: 42,246

- Funded Mutual Fund Window Accounts: 2,185