We are almost eleven months into 2022, and TSP investors are still seeing a great deal of red ink in their portfolios for the year. Of course, the same is true of all stock market investors as this has been a rough year for stock market returns.

But, as of the close of the stock market on November 17th, 2022, the performance for all TSP Funds for the month is positive. The I Fund has the largest gains for the month so far with an eye-popping return of 9.49%. This fund is still down 15.58% so far in 2022. While it may seem as though it was in the distant past, in 2021 the I Fund performance provided investors with a return of 11.45%.

The S Fund still shows the largest loss for any of the TSP Funds in 2022 (-23.47%). Long-term investors may recall that the S Fund provided investors with these returns in the three previous years:

- 12.45% in 2021

- 31.85% in 2020

- 27.97% in 2019

2022 TSP Performance Through November 17th

The table below lists the 2022 TSP performance so far in November and for the year-to-date in 2022 as of November 17, 2022. So far this month, the stock funds are performing well, although losses are still significant for the year. The significant decline in the price of stocks has also led to a 42% drop in the number of TSP millionaires since 2021.

| Fund | Month to Date | Year to Date |

|---|---|---|

| G Fund | 0.20% | 2.49% |

| F Fund | 2.55% | -13.22% |

| C Fund | 2.06% | -16.01% |

| S Fund | 0.46% | -23.47% |

| I Fund | 9.49% | -15.58% |

| L Income | 1.37% | -2.82% |

| L 2025 | 2.03% | -6.62% |

| L 2030 | 2.89% | -9.92% |

| L 2035 | 3.15% | -11.17% |

| L 2040 | 3.40% | -12.34% |

| L 2045 | 3.61% | -13.40% |

| L 2050 | 3.81% | -14.35% |

| L 2055 | 4.36% | -16.66% |

| L 2060 | 4.36% | -16.67% |

| L 2065 | 4.36% | -16.68% |

Calls to TSP Support Are Dropping

At the monthly meeting of the Federal Retirement Thrift Investment Board (FRTIB), Jim Courtney, Office of Communications and Education, reported that calls to the Thrift Savings Plan Thriftline are dropping. The number of calls was down 10% in October and roughly half of the number of calls in August.

Email queries to the TSP were up 13% and live chats jumped up 29%.

Also, the number of FERS investors who are now receiving the full government match of 5% now stands at 85.4%. It has been two years since new employees were automatically enrolled at the automatic matching rate for the TSP.

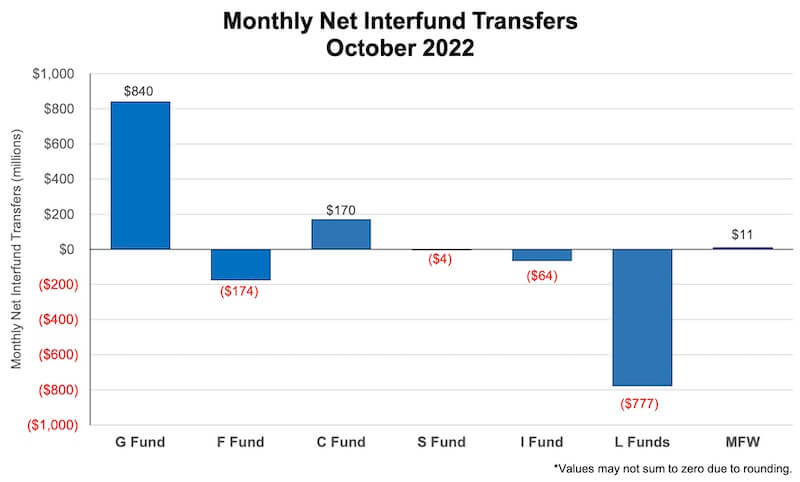

TSP Interfund Transfers in October 2022

In September, about $3.6 billion was transferred into the G Fund through interfund transfers. More than $1.6 billion was transferred from the C Fund and more than $1 billion from the Lifecycle Funds.

The trend for October 2022 is similar but considerably smaller. $777 million was transferred from the Lifecycle Funds and $174 million from the F Fund. $840 million was transferred into the G Fund and $170 million into the C Fund. Of course, there is about $720 billion in the TSP, so these transfers are a relatively small percentage of total assets.

This chart shows the latest transfer data from the FRTIB:

TSP Investment Allocations: October 2022

So far in 2022, there has been a change in how TSP investors are allocating their investment funds.

At the end of 2021, the C Fund was the most popular fund and the G Fund was second. While allocations to the G Fund have increased by more than 7% this year, the C Fund has dropped by about 4%. As some investors sought additional safety and risk, the S Fund allocations dropped by 2% and Lifecycle Fund allocation also went up slightly.

| Fund | October 2022 % Allocation | December 2021 % Allocation |

| G | 33.4% | 26.0% |

| F | 2.6% | 3.1% |

| C | 29.3% | 33.1% |

| S | 9.2% | 11.2% |

| I | 3.1% | 3.8% |

| Lifecycle | 22.3% | 22.8% |

2022 Winding Down

There are almost two weeks left in November and there is a major holiday this month, so market activity will likely be slower than usual. Historically, November is usually one of the best months of the year for stock returns. Over the last 39 years, the S&P 500 has risen 62% of the time for an average gain of +0.82% in November.

Obviously, there are a number of events this year that have dampened stock returns. Anyone who can predict what will happen in the remainder of 2022 is guessing as this is a turbulent year and any number of events can impact stock returns.

As a group, TSP investors typically do not rush to sell their TSP investments during market turbulence. That will be the most likely scenario this year as investors wait for events that will help provide a return to better investment performance. For those looking for good news, a divided government usually provides better stock returns than when one political party has control. As a result of the mid-term election that has just occurred, we will have a divided government when the new Congress convenes. That may be good news for stock investors.