Legislation was recently reintroduced in the Senate to authorize paying bonuses to federal employees who identify savings from surplus or unneeded government funds.

The Bonuses for Cost Cutters Act (S. 812) was reintroduced by Senator Rand Paul (R-KY). It has been introduced a number of times in the past in both the House and Senate.

What Would the Bonuses for Cost Cutters Act Do?

Federal law currently allows an agency’s Inspector General to pay bonuses of up to $10,000 of savings realized when a federal employee identifies waste, fraud, or mismanagement of funds. The legislation would expand these categories to include identifying surplus or unneeded funds.

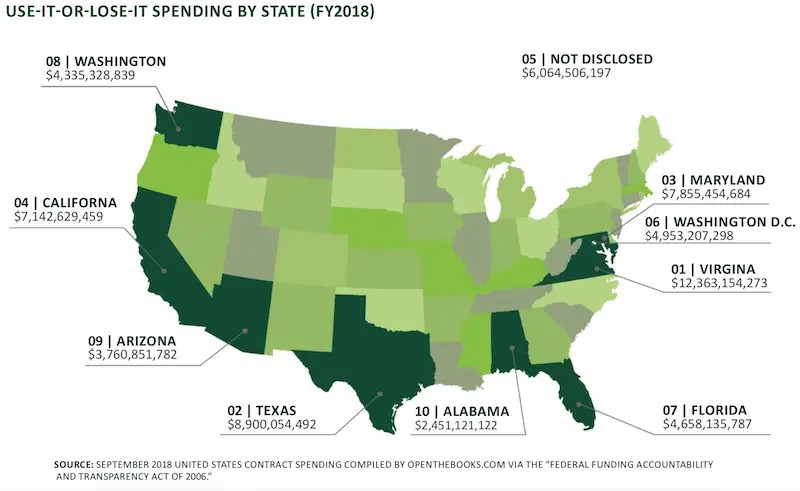

More suspect government spending is particularly noticeable and tends to increase sharply as the end of a fiscal year approaches. Federal agencies tend to spend more money in September because of the “use it or lost it” concept. The fear is that they could face budget cuts the next year if they do not utilize all allocated funds in any given fiscal year.

Reports have documented purchases made by agencies in September on items such as alcohol, expensive leather chairs, smartphones or golf carts.

In September 2019, the federal government spent $12.2 billion alone on the last business day of the year and $11.6 billion on the second to last day. Purchases included items such as guns and ammunition at non-military, non-law enforcement agencies, games, toys, musical equipment, and workout equipment.

The bill would also ensure that 90% of the savings are automatically directed towards deficit reduction. Agencies would be free to apply remaining funds to other agency priorities subject to current law.

In February 2023, the federal government ran a $263 billion deficit which increased by $47 billion year over year according to the Bipartisan Policy Center (BPC). Comparing FY 2023 year-to-date with FY 2022, BPC states that the federal government’s revenues were $1.7 trillion while outlays were $2.6 trillion. The outlays represent a 10% increase over last fiscal year primarily due to increasing interest payments on the public debt from rising interest rates.

The BPC writes:

Even during the years of economic growth immediately predating the COVID-19 pandemic, the federal government ran large and growing budget deficits, near $1 trillion per year. As policymakers enacted emergency measures to combat the COVID-19 crisis, federal budget deficits ballooned to levels not seen since World War II. Although the deficit has reverted to pre-pandemic levels as the United States winds down pandemic spending, deficits are projected to grow significantly over the coming decades—an ominous trend that will put increased strain on the federal budget.

In a statement about the bill, Senator Paul said:

Successfully tackling our debt crisis requires vigilance at all levels of government, from lawmakers in Congress to the employees on the front lines that carry out the day-to-day spending. The pressure in Washington to spend all you can before the end of the fiscal year so you can get even more in the future is enormous. Bonuses for Cost-Cutters pushes back against this status quo, providing additional incentive to save taxpayer resources.