Positive TSP Performance in April in Midst of Bear Market

For the second month in a row, stocks are generally higher. That is good news for the TSP’s performance and federal employees and retirees investing in the TSP funds. To put this in perspective though, S&P 500 stock index (the index on which the C Fund is based) is still in a bear market. This means the market is down 20% or more from its high and has been for more than 220 days. That is the longest stretch for a bear market since 1973.

For those with a good long-term memory, it means that the current bear market has outlasted the stock market’s bust in the dot-com bubble of 2001 and the financial crisis upon us back in 2008.

Stock market investors who do not pay attention to how events are shaping the market can get burned. No investment advisor can always predict the future or how stocks will react. We do know that what often happens in the stock market is that stocks that have been down for some time will often start to outperform other market segments.

I Fund Leads TSP Core Funds for April, 12 Months, and Year-to-Date

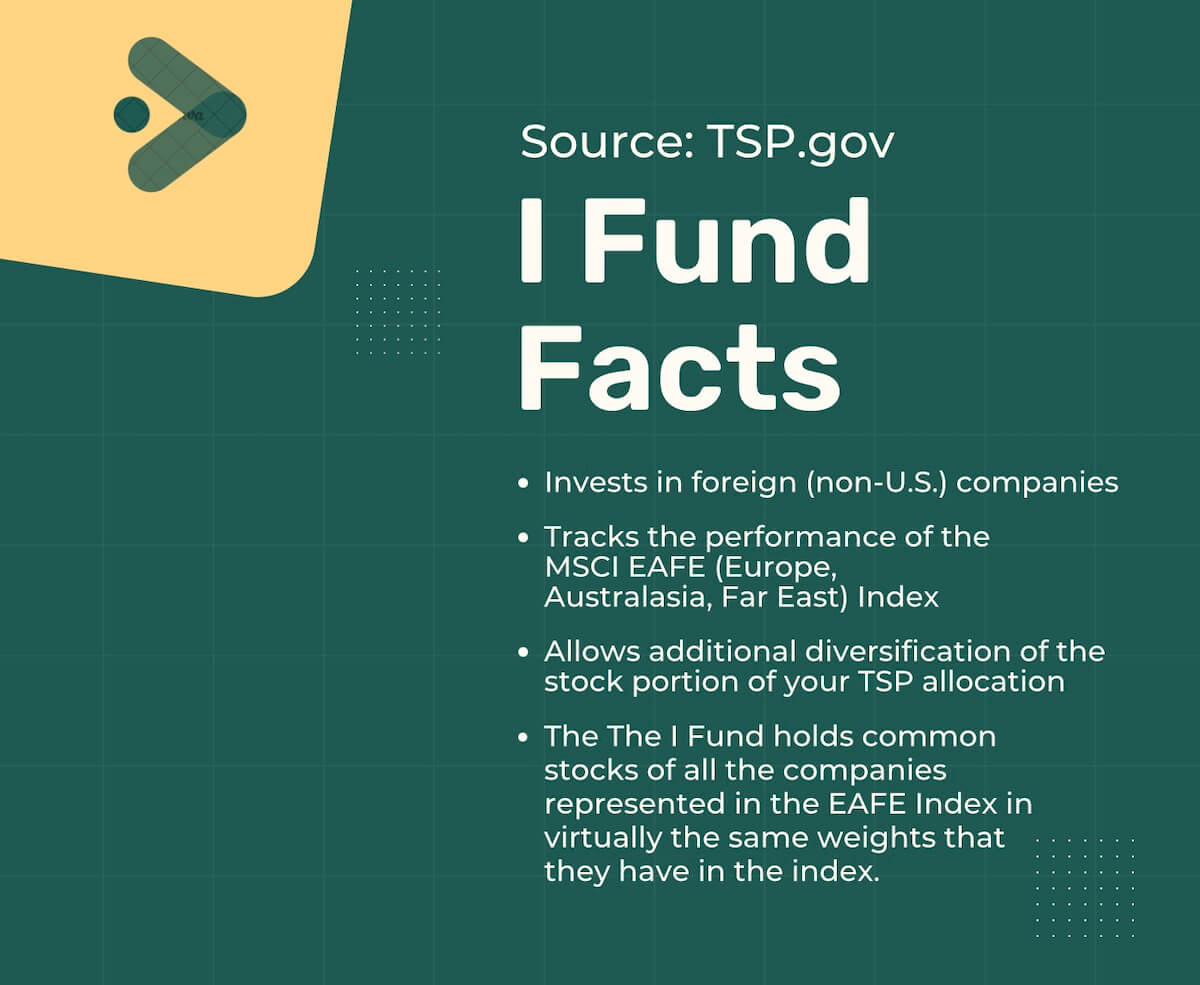

The I Fund in the TSP invests in foreign stocks. Here is how the TSP describes the I Fund:

Investment in the I Fund offers the opportunity to experience gains from equity ownership of non-U.S. companies. Because it represents the stocks of companies in many developed countries (excluding the U.S.), it is an excellent way to diversify the stock portion of your TSP allocation.

In recent years, the I Fund has generally lagged behind the better-performing TSP stock funds.

Surprise!

So far in 2023, the I Fund is ahead of every other fund in the Thrift Savings Plan (TSP). For April, it gained 2.87%. For the past 12 months, it gained 10.19%. So far in 2023, it has gained 11.74%.

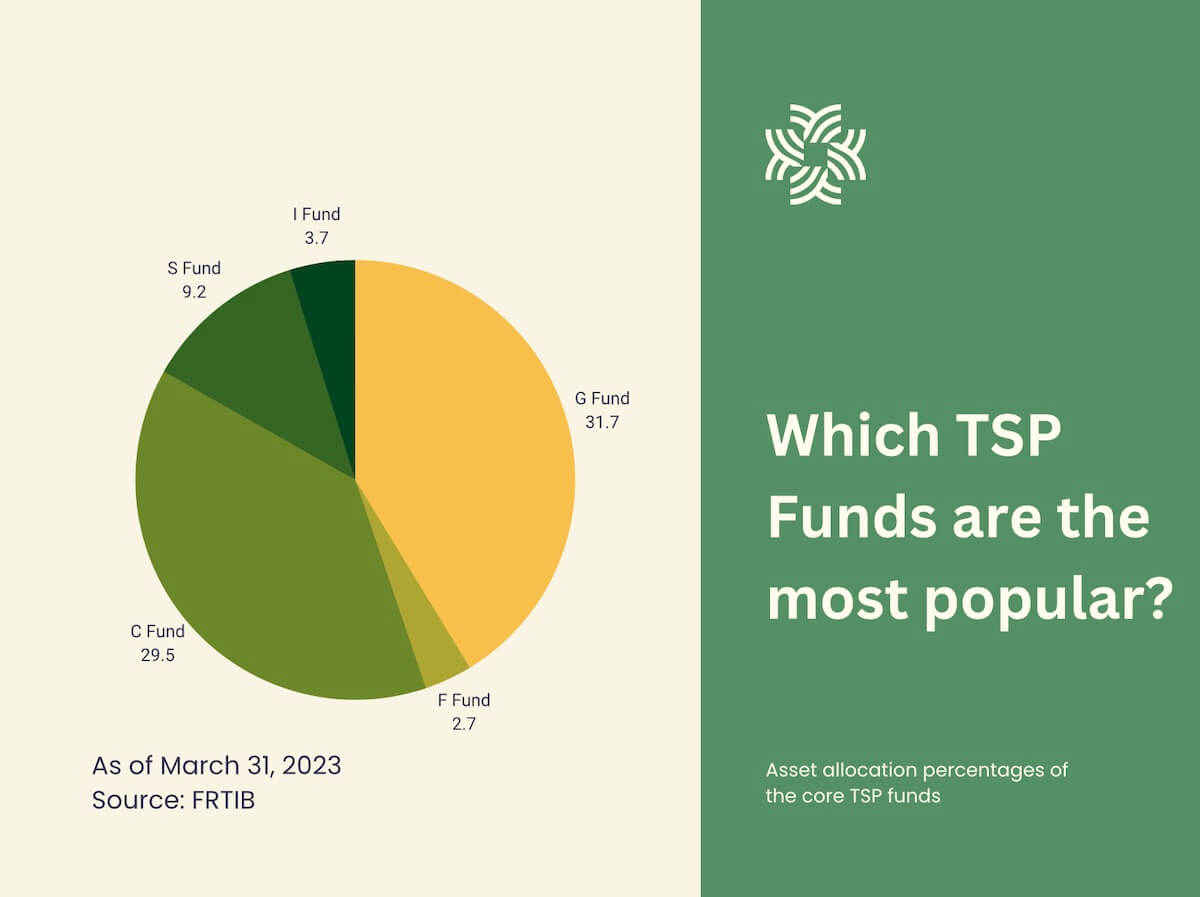

As noted in a recent article, only 3.7% of TSP investor funds are invested in the I Fund. It is easy to see why this is the case. For many years, the I Fund has lagged behind the C Fund and the S Fund in the TSP.

There is also an inherent hesitation to invest in foreign stocks. Perhaps it is patriotic to invest in domestic funds. It also seems safer to invest in domestic stock funds as we may be more familiar with some of those companies.

International Stocks Often Outperform U.S. Stocks

Here is something to consider.

International stocks have not performed as well in recent years. Throughout history though, international stocks have provided favorable returns for investors. In fact, foreign stocks have outperformed American stocks in roughly half of all time periods over the last 50 years.

Blackrock is the primary advisor for the TSP for investing TSP investor funds. This is what Blackrock writes about international stocks:

With lower returns forecasted for U.S. stocks over the coming years, international stocks may be primed to outperform. Historically, international stocks outperformed 96% of the time when U.S. stocks returned less than 6% and 100% of the time when U.S. stocks returned less than 4%.

American stocks make up about 55% of public markets. Foreign stocks make up the remaining 45%. As with the TSP allocations, most investors do not have anywhere near the allocation of 45% of foreign stocks.

Determining your allocation in foreign stocks can be tricky. Some stocks on American stock exchanges are foreign companies that do a great deal of business in our country. The Lifecycle Funds automatically include a small percentage of the I Fund as well.

With TSP investors only including about 3.7% of the I Fund in their portfolios, most investors are missing out on the better returns of the I Fund in recent months. Of course, these investors also did better than those that had a great deal more money in the other core TSP stock funds.

U.S. Stock Market Predicted to Lag

Stock investors are expecting American stocks to lag behind other parts of the world in 2023. One reason is the low-interest rate bubble is over. The U.S. economy has generally been stronger than the rest of the world since the recession in 2009. That is no longer the case.

In America, we have had a policy of loose credit for more than a decade. A “stimulus package” was passed in response to the recession. This loose monetary policy continued with tax cuts (from both political parties) that were not matched by spending cuts. In fact, government spending increased.

The result has been high inflation. The value of the dollar is very high. Our national debt is now at about $31 trillion and growing. An election is coming next year and the debate over how to accommodate our high national debt and high spending levels is unresolved. Some analysts see these factors as leading to foreign stocks performing better throughout the year.

That prediction may turn out to be true but we will not know until next January. Unexpected events can occur and predicting how governments will react may be difficult.

Diversification of an investment portfolio is usually a good idea, and 2023 is no exception.

TSP Returns for April, 12 Months and Year-to-Date

| Fund | April | Year-to-Date | 12-Months |

|---|---|---|---|

| G Fund | 0.30% | 1.28% | 3.62% |

| F Fund | 0.61% | 3.76% | -0.25% |

| C Fund | 1.56% | 9.16% | 2.62% |

| S Fund | -2.18% | 3.54% | -5.94% |

| I Fund | 2.87% | 11.74% | 10.19% |

| L Income | 0.63% | 3.41% | 4.08% |

| L 2025 | 0.79% | 4.54% | 3.77% |

| L 2030 | 1.07% | 6.31% | 4.29% |

| L 2035 | 1.13% | 6.80% | 4.24% |

| L 2040 | 1.20% | 7.27% | 4.20% |

| L 2045 | 1.25% | 7.68% | 4.13% |

| L 2050 | 1.31% | 8.07% | 4.08% |

| L 2055 | 1.48% | 9.27% | 4.16% |

| L 2060 | 1.48% | 9.27% | 4.15% |

| L 2065 | 1.48% | 9.27% | 4.15% |

Comparing Three TSP Core Stock Funds

For long-term investors, having a diversified portfolio is usually the safest approach to keeping your wealth. Those that follow this policy may not have the best-performing results to brag about to co-workers, but riding the inevitable ups and downs in the stock market usually rewards those who diversify.

The I Fund may finish up 2023 ahead of every other TSP Fund. It may finish behind other funds. Having foreign stocks in your portfolio is one way to diversify your TSP investments.

Take a look at the three core TSP stock Funds. The S Fund is more volatile than others. This Fund invests in smaller companies. These companies often do well when the market is going up. They often do not do as well when the market goes down. The C Fund is made up of solid American companies. The I Fund is invested in foreign companies.

All of these funds have advantages. They often do not perform the same. No one can accurately predict when each fund will perform better (or worse) than the others. All of them have provided investors with a good return over time.

| Year | S Fund | C Fund | I Fund |

| 2020 | 31.85% | 18.31% | 8.17% |

| 2021 | 12.45% | 28.68% | 11.45% |

| 2022 | -26.26% | -18.13% | -13.94% |

| YTD (4/30/23) | 3.54% | 9.16% | 11.74% |