The Federal Retirement Thrift Investment Board (FRTIB) announced in its latest monthly meeting that TSP participants can now track the status of TSP loans in real-time with a new feature on the website. The FRTIB also discussed recently introduced legislation that would allow some non-federal employees to be moved into the Federal Employees Retirement System (FERS) and also participate in the Thrift Savings Plan (TSP).

Highlights from the October 2023 TSP Board Meeting

Here are highlights from the latest monthly meeting of the Federal Retirement Thrift Investment Board (FRTIB):

- All third-quarter statements have been delivered to participants’ secure

mailboxes in MyAccount. - The number of Blended Retirement System (BRS) participants surpassed

the legacy Uniformed Services (U.S.) participants for the first time.- BRS: 1.31 million

- Legacy U.S.: 1.29 million

- The full matching rate for BRS active-duty participants sets a record high at

84.9%. - TSP participants who requested loans now have access to real-time status in

MyAccount using the new Loan Tracker.

TSP Loan Tracker Addition to TSP Website

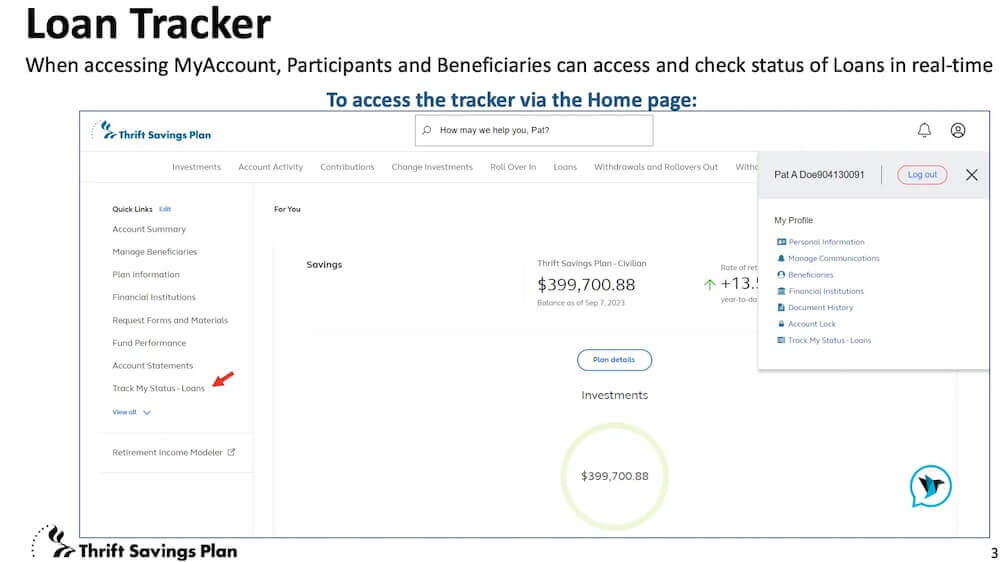

The new TSP loan tracker allows TSP participants to track the status of loans in real-time. It can be accessed from the main page after logging into MyAccount on the TSP website. The screenshot below provided by the TSP shows where the link can be found.

Future changes will include being able to sign up for text alerts on the status of loan applications.

Legislation Introduced to Expand TSP, FERS Participation to Non-Federal Employees

Congressman Gabe Vasquez (D-NM) has introduced a bill (HR 5669) that would expand coverage of the TSP. The bill is entitled the Parity for Tribal Educators Act.

In a press release, Vasquez wrote: “My bipartisan bill, the “Parity for Tribal Educators Act,” will help address the teacher shortage by providing all Tribal teachers with the retirement benefits they deserve and that fulfill the federal government’s trust responsibility to Tribal nations.”

The bill would provide FERS and TSP benefits for employees of tribally controlled schools. Under the bill, the Bureau of Indian Affairs (part of the US Department of Interior) “shall pay the Government contributions” for these retirement programs.

Kim Weaver, Director of External Affairs for the Federal Retirement Thrift Investment Board, reported, “We have no objection with the bill” which would cover about 10,000 people.

The tribal schools are in remote areas of the country and widely dispersed, and she sees the data transfer necessary to incorporate them into the TSP would be the biggest issue from the standpoint of the TSP. This is the first time this bill has been introduced.

The employees of the tribally controlled schools are not federal employees. Adding a new category of employees is a unique situation. Employees of the schools run by the federal government are already covered but those run by tribes are not covered.

Latest TSP Returns

The third quarter of 2023 was not good for investors watching their Thrift Savings Plan (TSP) returns. In the third quarter, the return on longer-term government bonds soared. The result was a drop in stock values. Not long ago, the TSP’s C Fund was up about 20% for the year. It is now showing an increase of 11.26% so far this year. That is still a good return. But, as seen in the chart below, it is down again in October.

While it may seem hard to believe after the third quarter results, all TSP Funds, except for the F Fund, are still up in 2023. The biggest gains are in the C Fund, with a return of 11.26%. The S Fund has had the most significant decline so far this month, but it is still up 2.61% for the year. Despite a positive return this year, the C Fund was down 4.77% in September and is down another 1.58% in October.

TSP Returns for All TSP Funds—Month and Year-to-Date

| Fund | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.30% | 3.29% |

| F Fund | -1.55% | -2.57% |

| C Fund | -1.58% | 11.26% |

| S Fund | -5.73% | 2.61% |

| I Fund | -3.23% | 3.48% |

| L Income | -0.55% | 4.08% |

| L 2025 | -0.85% | 4.86% |

| L 2030 | -1.60% | 5.60% |

| L 2035 | -1.80% | 5.76% |

| L 2040 | -1.99% | 5.96% |

| L 2045 | -2.16% | 6.11% |

| L 2050 | -2.31% | 6.30% |

| L 2055 | -2.71% | 7.34% |

| L 2060 | -2.71% | 7.34% |

| L 2065 | -2.72% | 7.33% |

Transfers to G Fund Exceed $2 Billion in September

With the stock market’s performance last month, it is unsurprising that the G Fund transfers increased by about $2.1 billion. At the same time, the transfers out of the S Fund were about $1.17 billion. The F, I, and C Funds also had a few million dollars transferred out and into the G Fund.

These recent transfers put the total G Fund assets closer to the assets of the C Fund. Participant allocation of their TSP investments in the G Fund now total 30.2% of assets while the C Fund remains the most popular fund at 30.8%.

With $783 billion of assets in the TSP, the monthly interfund transfers are a small percentage of total TSP assets. The transfer trend often falls into a pattern, as some TSP investors gradually add money into the stock funds as the stock market moves higher and transfer funds out of the stock funds as the market falls.