The 2024 contribution limit to the Thrift Savings Plan is increasing to $23,000 per year, an increase of 2.2% over the 2023 annual limit, according to an announcement from the Internal Revenue Service.

The 2024 TSP contribution limit ended up being precisely in line with projected estimates that were released over the summer.

Federal employees saving in the Thrift Savings Plan (TSP) will be able to contribute a maximum of $23,000 in 2024. The 2023 contribution limit was $22,500.

The catch-up contribution limit for 2024 will remain the same at $7,500. This allows federal employees aged 50 and up to make this extra contribution to the TSP each year (for a total of $30,500) to further boost their retirement savings.

2024 IRA Contribution Limits

The 2024 IRA annual contribution limit is increased to $7,000, up from $6,500 in 2023. This is an increase of 7.7% over last year.

The IRA catch-up contribution limit for individuals aged 50 and over was amended under the SECURE 2.0 Act of 2022 to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. Individuals who utilize this option will be able to contribute a total of $8,000 per year to an IRA in 2024.

2024 Roth IRA Income Phase-Out Ranges

The income phase-out range for Roth IRA contributions will be increased to between $146,000 and $161,000 for singles and heads of household, up from between $138,000 and $153,000 in 2023.

For married couples filing jointly, the income phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000 in 2023.

The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is not subject to an annual cost-of-living adjustment and remains between $0 and $10,000.

2024 Traditional IRA Income Phase-Out Ranges

According to the IRS, taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor the spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.)

These are the traditional IRA phase-out ranges for 2024:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to between $77,000 and $87,000, up from between $73,000 and $83,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to between $123,000 and $143,000, up from between $116,000 and $136,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains between $0 and $10,000.

Past Annual TSP Contribution Limits

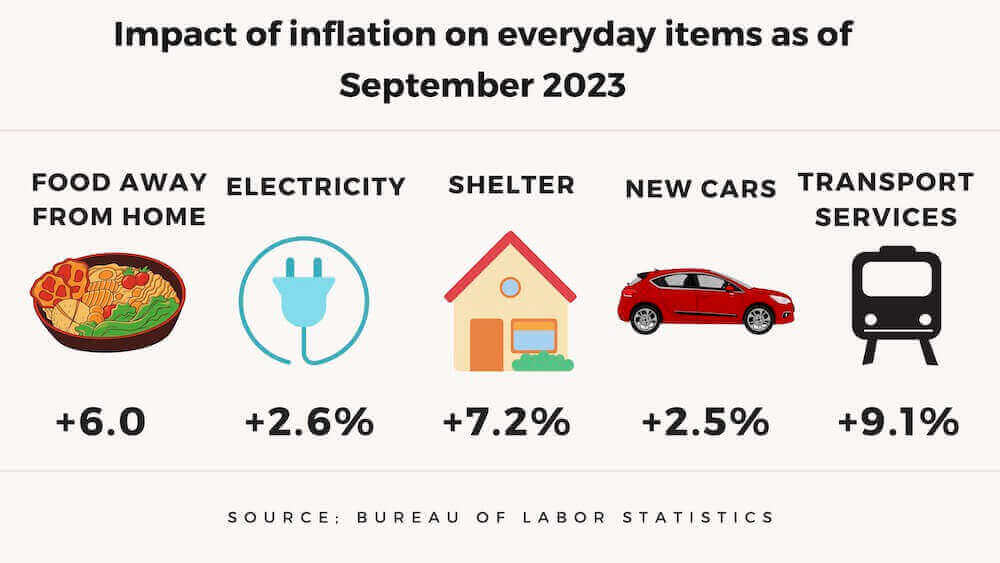

Inflation has risen sharply in recent years which led to some of the largest cost of living adjustments (COLAs) for federal retirees in 40+ years. The 2022 COLA was 5.9%, the largest in 40 years at that time, and the 2023 COLA was even higher at 8.7%.

Rising inflation also helped drive up the 2022 and 2023 annual TSP contribution limits since they are subject to annual cost of living adjustments. The annual TSP contribution limit has risen 31.4% since 2013. It has increased 18% since 2021 alone which accounts for over half of the increase.

The table below shows the annual TSP limits going back to 2013.

| Year | Annual Contribution Limit | Catch-Up Contribution Limit | Total |

| 2024 | $23,000 | $7,500 | $30,500 |

| 2023 | $22,500 | $7,500 | $30,000 |

| 2022 | $20,500 | $6,500 | $27,000 |

| 2021 | $19,500 | $6,500 | $26,000 |

| 2020 | $19,500 | $6,500 | $26,000 |

| 2019 | $19,000 | $6,000 | $25,000 |

| 2018 | $18,500 | $6,000 | $24,500 |

| 2017 | $18,000 | $6,000 | $24,000 |

| 2016 | $18,000 | $6,000 | $24,000 |

| 2015 | $18,000 | $6,000 | $24,000 |

| 2014 | $17,500 | $5,500 | $23,000 |

| 2013 | $17,500 | $5,500 | $23,000 |