People frequently ask us: are there any tips that we can put to use before the year ends that are going help put us in a better financial position? The financial planning business gets quite busy in the fourth quarter, and for good reason.

There are a lot of strategies that can help you make the most out of your money, and for many of these, you’ll want to start planning for and thinking about them well ahead of the year-end.

In this column, we’ll cover various strategies for you to consider in your own circumstances to help you save on taxes, increase your wealth, and strengthen your financial position.

These strategies will build on each other, so if one is not immediately relevant, continue reading to ensure you understand how it all comes together. Many of these strategies must be implemented before the calendar year ends.

Prepare for Capital Gains Distributions

If you own mutual fund investments inside non-retirement accounts, this is coming for you. Right around this time of year, mutual funds will pass on their capital gains distributions to you as the investor.

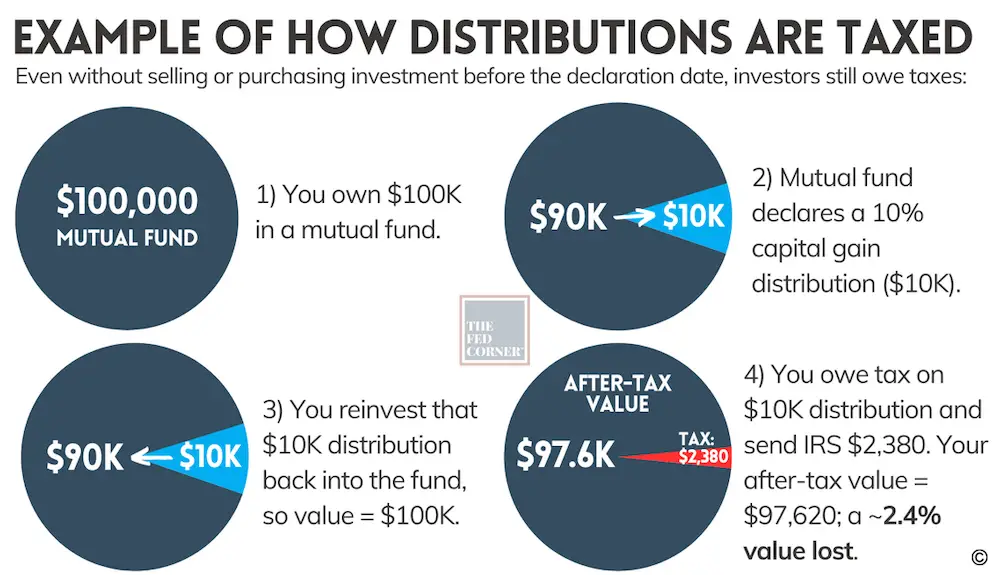

Even if you don’t sell any of your investments, you will still owe taxes on these capital gains distributions. The graphic below illustrates an example of how this happens:

The first question to ask yourself is whether your portfolio is being managed properly. If you paid capital gains taxes last year on these investments, then there is an obvious opportunity for improvement.

Non-retirement accounts should be tax-managed on a regular basis. Strategies like tax-loss harvesting, tax-lot swaps/coordination, holding period management, tax-efficient investments, and others are all ways that you can keep more of what you earn.

You may be paying unnecessary amounts of taxes. We saw this happen big time last year. The markets were down double digits in value, and investors across America also had to pay taxes after having lost money.

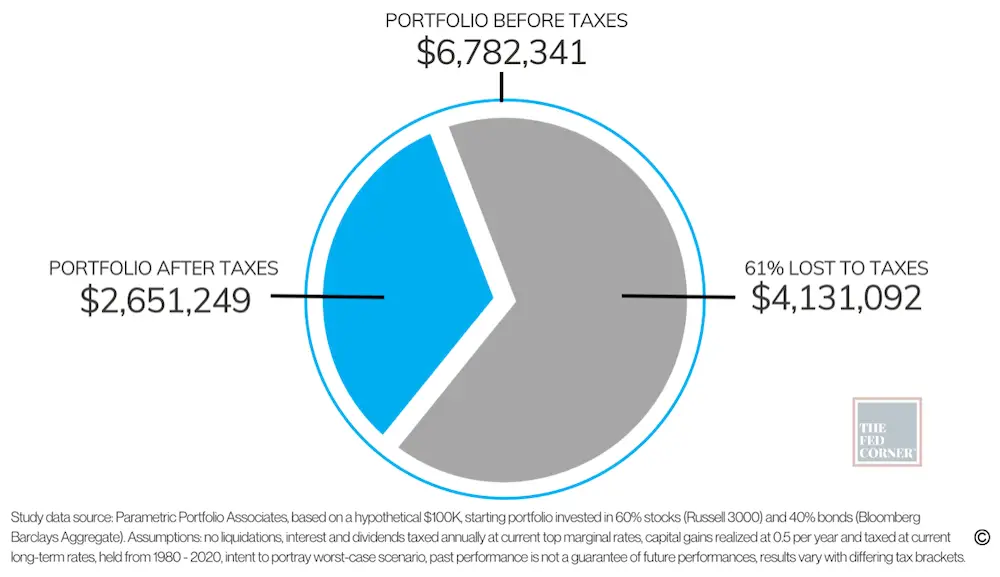

Parametric conducted a study on the long-term impact of neglecting to do this kind of planning. They took $100,000 invested for 40 years as outlined in the language below without implementing the tax-planning along the way. The results are stark:

While the growth assumptions in this study were a bit aggressive for the average federal employee in my opinion, there is no doubt that this kind of planning adds massive value.

We do this regularly for our clients and see first-hand the positive impact it can have. I encourage you to explore it for yourself as we head towards the end of the year.

Keep the Growth Going with IRA Contributions

The first item to consider as the end of the year approaches is whether you want to make IRA contributions.

Contributing to your TSP is great. You should be maxing it as best you can. But just because you max your TSP doesn’t mean you should stop saving, and there are a few ways to do this.

At a high level, there are two types of investment accounts: retirement, and non-retirement. Once you’ve maxed your TSP, you can also save in non-retirement accounts. These are post-tax dollars that get to grow for you while being taxed at the more favorable capital gains rates (compared to ordinary income tax—think: salary—from your traditional TSP).

But beyond that, did you know that you can also make an IRA contribution if you’re still working? This is even more money that can be growing for your future.

However, if you have a retirement account like the TSP and you earn over a certain amount of income, you might not be able to deduct that IRA contribution.

Then people often ask: why would we make an IRA contribution if we can’t deduct it?

This money still grows tax-deferred. Albert Einstein talks about compound interest as the eighth wonder of the world, with the power of compounding being the strongest force in the universe.

The longer you allow your money to compound, the greater the benefit to your wealth.

It’s important to note that performing a non-deductible IRA contribution requires that you track the after-tax basis, but this is done by filing Form 8606 when you file your tax return. Better yet: ask your accountant to handle it.

How much can you contribute? Here’s a chart:

| IRA Type | Year | Contribution Limit | Catch-up (50+) | Income Limits |

| Trad. nondeductible | 2023 | $6,500 | $1,000 | No income limit |

| Traditional deductible | 2023 | $6,500 | $1,000 | If covered by TSP or Plan: $116K – $136K joint $73K – $83K single & HoH $0 – $10K married filing sep. If 1 spouse is covered by Plan: $218K – $228K joint |

| Roth | 2023 | $6,500 | $1,000 | $218K – $228K joint $138K – $153K single & HoH $0 – $10K married filing sep. |

| Roth Conversion | 2023 | n/a | n/a | No income limit |

Data source: IRS.gov

Invest in Your Kids’ Futures with Children IRA Contributions

If your kids had a summer job and earned income, they’re probably going to want to use that money for school, hanging out with friends, pizza money, etc.

But as (grand)parent, you can also contribute to an IRA for them. The IRS doesn’t care where the money came from, so long as they have earned income. So they get to keep the cash they earned, but they’re still able to have an IRA contribution for themselves. Just make sure to understand the annual gift tax rules and other considerations.

Some of our clients make IRA contributions for their (grand)children on an annual basis even though the kids are well into their 20s.

The kids, being under 50, can have up to $6,500 contributed to an IRA for them, depending on how much they earn. This is an excellent way to start helping kids save and think about investing for their own future.

We almost always suggest a Roth IRA for the kids, as they’re likely in a very low tax bracket and don’t need the deduction. If started early enough and managed properly, these tax-free accounts can grow to six figures before they’re even 30 years old.

Earn Tax-Free Growth with Backdoor Roth IRA Contributions

Speaking of Roth IRAs, the backdoor Roth strategy is easily one of the most underutilized planning strategies.

If you earn over a certain income limit (see chart above), you are no longer eligible to make a Roth IRA contribution. Note that you can still contribute to the Roth TSP.

But if you’re already maxing out your TSP and you still have extra income you’d like to save and invest, we go back to the two options again: retirement or non-retirement.

Non-retirement accounts are nice because they’re “back pocket money”, meaning if you’re old enough to tap into IRAs without being penalized, non-retirement accounts are available to you.

But if you’re certain you won’t need this money until you’re 59.5, then consider utilizing a Roth account instead. Growth on non-retirement accounts is subject to capital gains taxes. Growth in Roth IRAs is completely tax-free.

Remember those non-deductible IRA contributions we discussed earlier? Non-deductible means this money was already taxed, and you may be able to transfer this into a Roth IRA (thus performing a conversion) with no additional taxes. Now this money gets to compound completely tax-free for you.

Contributing to a non-deductible IRA and then transferring it into a Roth IRA is how to effectuate a “backdoor” Roth contribution and allows you to benefit from the Roth even when earning too much income.

Make sure you check out whether this one is right for you too.

Prepare for Required Minimum Distributions (RMD)

When you reach a certain age, you have to start taking out minimum amounts from your pre-tax retirement accounts. Why?

Because the money that comes out is fully taxed, it’s a mechanism to get you to pay the owed taxes on that money that’s grown and has not yet been taxed.

This means that you will need to sell investments to take that money out, so start thinking about which buckets from your portfolio should be used for this.

Here are some concepts you may want to consider:

- Do you want to time this transaction with a portfolio rebalance?

- Do you want to use cash you already have on hand?

- Perhaps you consider taking your RMD from your highest-grown investments.

- Maybe you wish to accelerate your distributions if you anticipate higher tax rates in the future.

- Maybe you prefer to use QCDs to satisfy your RMD (see next section).

RMDs must be performed by December 31st, but many custodians have earlier cutoffs so don’t procrastinate. The TSP will automatically process your RMD.

Consider a Qualified Charitable Distribution (QCD)

A qualified charitable distribution (QCD) allows a person 70.5 years old or older to donate up to $100,000 to a qualified charity.

The benefit of doing this is that the IRS considers QCDs to count towards satisfying your annual RMD amount, but any dollars donated are not taxable to you or the charity.

This may allow a federal retiree to avoid being pushed into higher income tax brackets and prevent additional taxes and the phaseout of other beneficial tax deductions.

Remember that taxes are overlaid throughout your financial picture. Once you stop earning an income and live on your savings, you can plan carefully to help keep as much of your own money as possible.

If an RMD pushes you into a higher tax bracket, you pay more in taxes not only on your distribution, but also your FERS pension, and possibly Social Security and capital gains as well.

Forbes estimates almost 90% of people take the standard deduction on their taxes. When you write a check to a charity or church/nonprofit, you’ve already paid taxes on that money. Using the standard deduction means you may have had no tax benefit from your donation. A QCD may be a better way to donate.

Now, the devil is in the details. Here’s what to keep in mind:

- You must be 70½ or older to be eligible to make a QCD

- The maximum distribution is $100,000 (Indexed starting in 2024), per taxpayer

- QCD equals a reduction to AGI, it is not an itemized charitable deduction

- Distribution must be made to a public charity

- A donor-advised fund is not a public charity

- QCDs must be paid directly to a qualified charity

- Qualified charitable distributions count towards RMDs

Potential benefits include:

- Adjusted Gross Income (AGI) falling below the threshold of the Net Investment Income Tax

- Less of your FERS annuity income will be subject to tax

- Less of your Social Security Income will be subject to tax

- A lower AGI could mean more medical expenses being deductible

One important caveat of using a QCD to satisfy an RMD obligation is that an RMD is presumed to be satisfied by the first distribution that comes out for the year.

If you already take retirement account distributions during the year that may satisfy your RMD, consider implementing QCDs in the beginning of the year.

Closing

The end of the year is right around the corner and some of these strategies can be complex. There are great things you can do that move the needle every year and help you make the most out of your money—they require careful planning ahead of time so make sure you allow yourself enough time. If you’re interested in more thoughts like these from our team, you can find them here.