The OPM retirement backlog dropped to another seven-year low at the end of 2023. The total backlog of outstanding retirement claims now stands at 14,292. The last time it was at or below that level was at the end of June 2016.

The Office of Personnel Management (OPM) received 5,662 new retirement claims in December and processed 7,196, a difference of 27%. This helped to reduce the backlog by 9.7% over November, going from 15,826 to 14,292.

On average, it took OPM 68 days to process retirement claims in December. For 2023, the monthly average was 73 days.

Fewer Federal Employees Retired in 2023 Than in Previous Years

OPM received 88,773 retirement applications from retiring federal employees in 2023. The monthly average was 7,398. As is often the case, the most applications came in January (12,404).

Based on the OPM retirement statistics, far fewer federal employees retired in 2023 than in the five years prior. Here is a summary:

| Year | Total |

|---|---|

| 2023 | 88,773 |

| 2022 | 102,819 |

| 2021 | 104,699 |

| 2020 | 92,088 |

| 2019 | 101,580 |

| 2018 | 107,612 |

| Average | 99,595 |

OPM processed 96,077 retirement claims which helped reduce the total inventory throughout the year. 8,006 retirement claims were processed each month in 2023 on average. The total OPM retirement backlog was reduced by 34% from the end of December 2022 (21,596) to the end of December 2023 (14,292).

The OPM retirement backlog has declined for two years in a row now going from 26,730 at the end of 2021 to 14,292 to finish 2023, a 46.5% reduction.

| Year | Claims Received | Claims Processed | Difference | Backlog at Year End |

|---|---|---|---|---|

| 2023 | 88,773 | 96,077 | (7,304) | 14,292 |

| 2022 | 102,819 | 107,953 | (5,134) | 21,596 |

| 2021 | 104,699 | 97,656 | 7,043 | 26,730 |

| 2020 | 92,088 | 89,309 | 2,779 | 19,687 |

| 2019 | 101,580 | 102,691 | (1,111) | 16,908 |

| 2018 | 107,612 | 104,108 | 3,504 | 18,019 |

The Retirement “Surge Period”

Most federal employees retire at the end of a calendar year. OPM always receives more retirement claims during January than any other month, but December through March is the timeframe that OPM refers to as its “surge period” for retirement applications.

Consequently, the OPM retirement backlog will likely grow between now and the end of January and will be reflected in the next monthly report. Last January for instance, it grew by 15% but in some past years it has grown by over 40%.

OPM announced in November that it was increasing staff capacity to handle the expected increase in incoming retirement applications from federal employees. The agency also asked for assistance from other agencies by establishing internal quality control processes to reduce the number of errors in submitted retirement applications and sending HR staff to OPM’s Retirement Operations Center in Boyers, PA to help with processing retirement applications during the surge period.

OPM’s Efforts to Reduce the Retirement Backlog

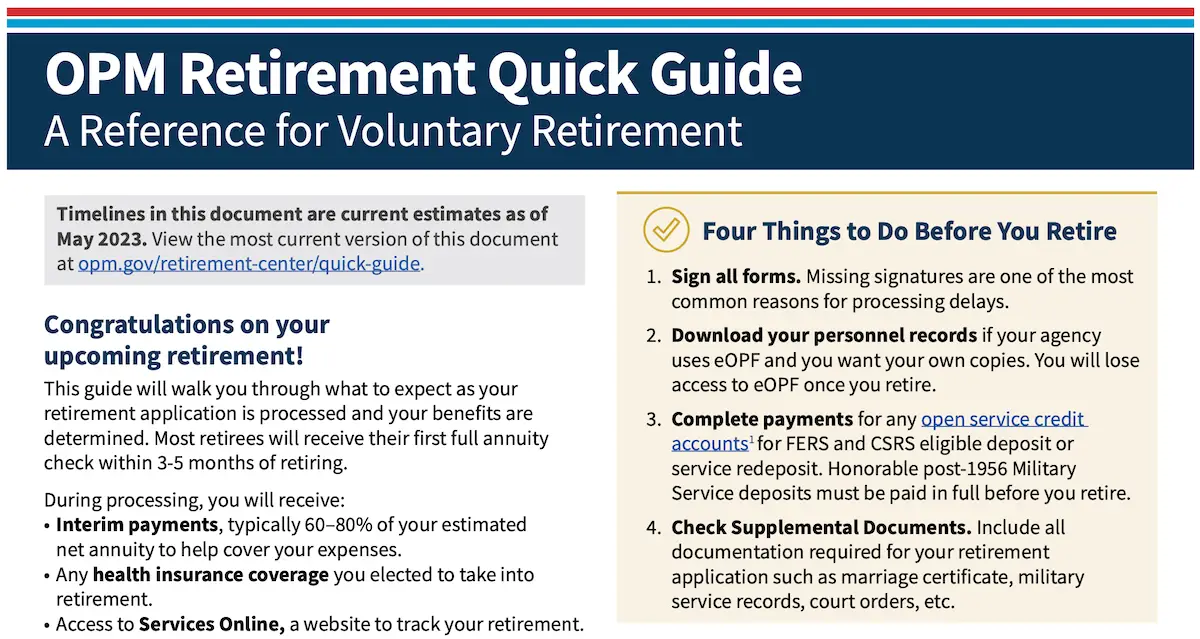

In addition to temporarily increasing processing staff, OPM also launched a new guide last May to help federal employees better understand the retirement application process and what to expect when they submit their retirement application packages.

The OPM Retirement Quick Guide walks federal employees through what to expect as a retirement application is processed and benefits are determined. One of its goals is to reduce the number of errors on retirement applications which is the single biggest factor in causing processing delays which in turn keep federal employees from getting their full monthly annuity payments as quickly.

OPM is also in the process of developing an online retirement application system with the intended goal of moving away from a paper-based process to one that will be faster. A recent Inspector General report noted that it is being tested at a small number of agencies.

The report stated that the agency’s reliance on a paper-based system is one of the primary causes of a slow, manually intensive process. However, the IG report, which was issued in November 2023, said that the “online retirement application is still in the early stages of development” and is “years from completion.”