C Fund Soaring in 2024

The stock market in February started 2024 with a strong performance, hitting record highs last month. That performance, of course, is good news for Thrift Savings Plan (TSP) investors.

The C Fund is up 7.1% for the year. It is the best-performing fund in the TSP so far this year.

The C Fund went up 5.34% in February. The S Fund performed even better during the month with a return of 6.03% and a year-to-date return of 3.48%.

The price of the C Fund at the close of business on February 29, 2024, was $79.64. That is a record high.

Stocks are off to their best start of a year since the Trump administration although not as high as in 2019. In the first two months of 2019, the C Fund was up 11.2%. Also in 2019, the S Fund was up 16.62% in the first two months.

For those wondering about the total returns for the year, by the end of 2019, the C Fund was up 31.45%, and the S Fund was up 27.97%.

The TSP returns are not that high in 2024 and recalling 2019 is not a prediction that the same stock market results will happen in 2024. It does mean that the returns so far this year are very good for TSP investors.

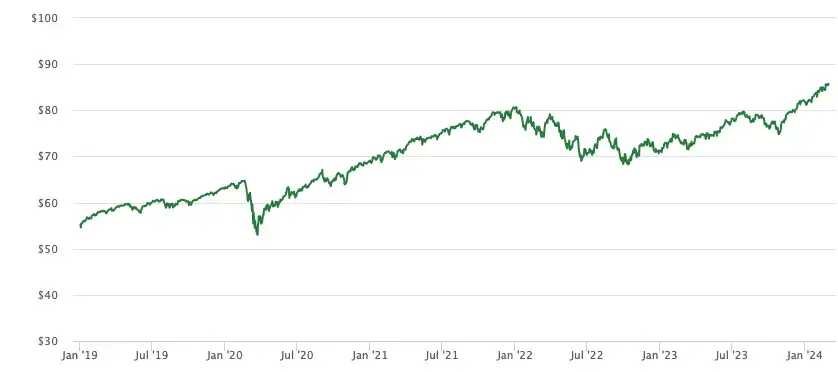

TSP C Fund Returns January 2019 – January 2024

TSP Returns for February 2024 and Year-to-Date

So far in 2024, all of the TSP funds have a positive return except the F Fund, down 1.6%.

| Fund | Monthly Return | Year-to-Date Return |

|---|---|---|

| G Fund | 0.33% | 0.67% |

| F Fund | -1.41% | -1.60% |

| C Fund | 5.34% | 7.10% |

| S Fund | 6.03% | 3.48% |

| I Fund | 2.74% | 2.51% |

| L Income | 1.29% | 1.66% |

| L 2025 | 1.63% | 2.01% |

| L 2030 | 2.74% | 3.15% |

| L 2035 | 2.96% | 3.38% |

| L 2040 | 3.20% | 3.62% |

| L 2045 | 3.41% | 3.83% |

| L 2050 | 3.62% | 4.04% |

| L 2055 | 4.48% | 4.95% |

| L 2060 | 4.48% | 4.95% |

| L 2065 | 4.48% | 4.95% |

TSP Highlights: TSP Assets and FERS Balances Growing

The number of TSP participant accounts reached 7,007,504 in January—a new record high. The TSP also reports that call center performance in January was good with an average wait time of 40 seconds. 80% of all calls were answered in 20 seconds. Participant satisfaction was 93.5%.

The TSP mailed out about 6.9 million statements and posted in “MyAccount” on the TSP website during February.

The average TSP balance for FERS employees was $176,090 in January, and the average Roth balance was $37,349. At the same time last year, the average balance for this group of TSP participants was $163,954, and the average Roth balance was $23,038.

The total assets in the TSP at the end of January 2024 were $849 billion and $55 billion in Roth assets. At this time last year, the total assets were $759 billion, and Roth assets were $42 billion.

Stock Market is Setting New Records: Should You Sell Your TSP Assets Now or Transfer to the G Fund?

I have been investing in stocks since about 1967. I read several books on the stock market and thoroughly enjoyed the thrill of capitalism and the possibility of making money by investing in the future of America.

I made about $100 buying and selling my first stock (Mack’s Department Stores). Today, that is a minuscule amount of money. My college tuition was about $400 a year so that seemed like a lot of money.

Having invested through the Vietnam War—while anticipating graduation from college and then likely flying to part of the world I could not find on a map in a war for a cause I did not understand—I always tried to keep a (very) small amount of money in stocks. Having gone through the turmoil of the ’60s, the massive drop in stocks in 1987, and the numerous ups and downs in stock prices and ever-changing world events impacting the stock market, I have stayed invested—sometimes by accident more than intent.

Various books explain how to get rich by buying and selling stocks. That works for some people. For most of us, predicting future events and the stock market’s direction is a fool’s game. Rebalancing your portfolio is a good idea; my (sometimes painful) experience of selling today because the market went up yesterday will hurt more often than it will help.

Federal employees have a big advantage. The TSP is an easy way to spread out your investments in either a Lifecycle Fund or the core TSP stock funds or some of both.

Here is a relevant quote from the Wall Street Journal today:

Even if the tech giants driving it (the stock market) higher aren’t riding a bubble, their lofty valuations make it likely that future rewards for investing will be lower. And the rest of the equity market isn’t particularly cheap either. So investors’ temptation to leave their cash parked in deposits or money-market funds is more than understandable. Right now, the latter are paying returns of 4.9% in the U.S.

But here is the problem: If you wait for rates to start coming down to buy riskier assets, you could be giving up on a lot of gains….

A raft of…research also shows that, historically, most stock-market gains have come during only a few days, sometimes right after central banks cut rates.

In plain English, this means getting out of the stock market when it is going up and selling stocks while guessing it has reached its highest point often leads to losing money. Most TSP investors invest and stay invested but probably rebalance their portfolios periodically.

A small percentage of TSP investors trade in or out of the G Fund frequently. Doing that is exciting. I understand the emotional rush of buying and selling stocks and hoping I have hit the next big stock gusher. The G Fund reduces risk as it always goes up, even in a down market.

My best investments have always been picking good stocks or good funds and holding on without watching daily returns. More importantly, as noted by the WSJ above, numerous research results show that is usually the case.

Federal employees have many advantages ranging from the unique features of the G Fund to having a low-cost investment plan available with government-matching assets to prepare for a secure retirement. Set aside a small portion of your assets to invest in individual stocks if you miss the thrill of buying, selling, and searching for the next home run in the stock market to retire early.

The Journal’s advice boils down to this: Avoid replacing the advantages of the TSP with the emotional high you expect from gambling in individual stocks or frequently buying and selling the funds. Of course, your expertise may enable you to find the next big hit and be on your way to having a few million dollars more to enjoy after leaving government service.

Part of the thrill of the stock market is you can make your own investment decisions—and then live with whatever consequences result from your actions.

We wish all FedSmith readers a happy and profitable 2024! Take the time to relish your great TSP returns in early 2024.