Is Inflation Starting to Surge Again and Why is The CPI Report Important?

Inflation has been of major importance during the Biden administration. While the larger inflation rates appear to be behind us, the March consumer price inflation report (CPI) may have a greater impact than these reports usually do.

Inflation reports have become a closely watched economic indicator since prices started surging three years ago. Today’s consumer-price index report reflecting the March inflation rate will be watched closely because Federal Reserve officials appeared willing to ignore higher-than-expected inflation readings for January and February.

The Wall Street Journal noted the March CPI report may be “one of the most critical U.S. data releases in recent memory.”

The Fed tries to avoid making policy on the basis of one or two data points, but the resilience of economic activity so far this year means the case for cutting interest rates by midyear hinges on seeing inflation resume its steady downtrend from the second half of last year.

Inflation Rises Again in March

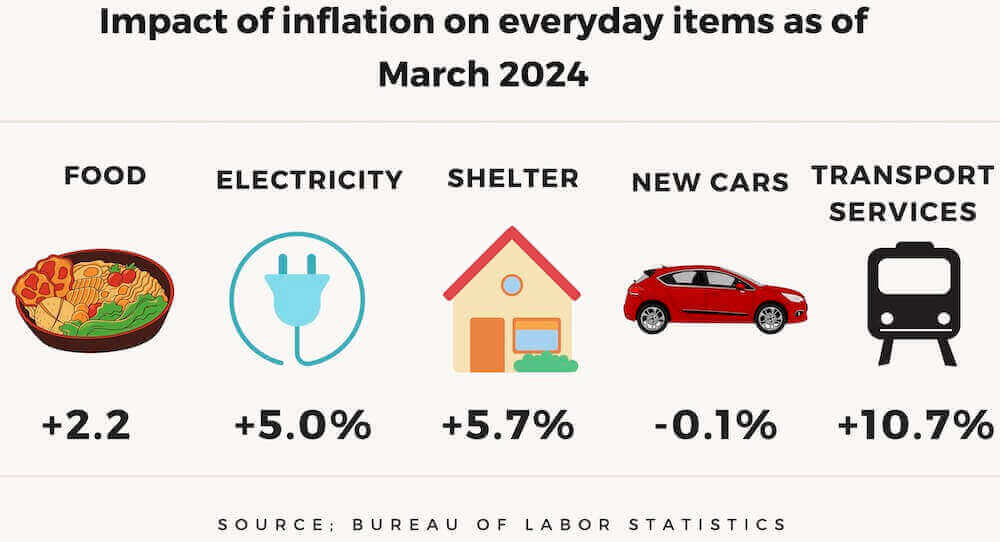

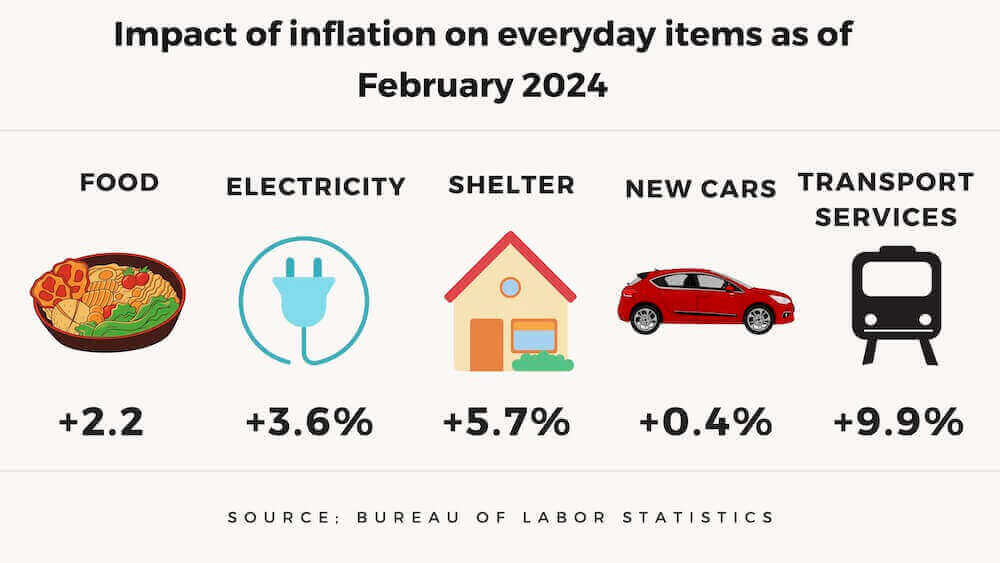

According to the Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% in March—the same increase as in February. Over the last 12 months, the all-items index increased by 3.5%. This figure was 3.2% in February.

The latest inflation rate is for the third straight month with a jump in inflation. Most of the increase is due to the cost of gas and rent which accounted for more than half of the increase.

Core prices, which exclude food and energy costs, were up 0.4%, as they were in January and February. Core prices rose 3.8% annually. These figures are also higher than earlier estimates.

For many readers, the most important data point is the CPI-W.

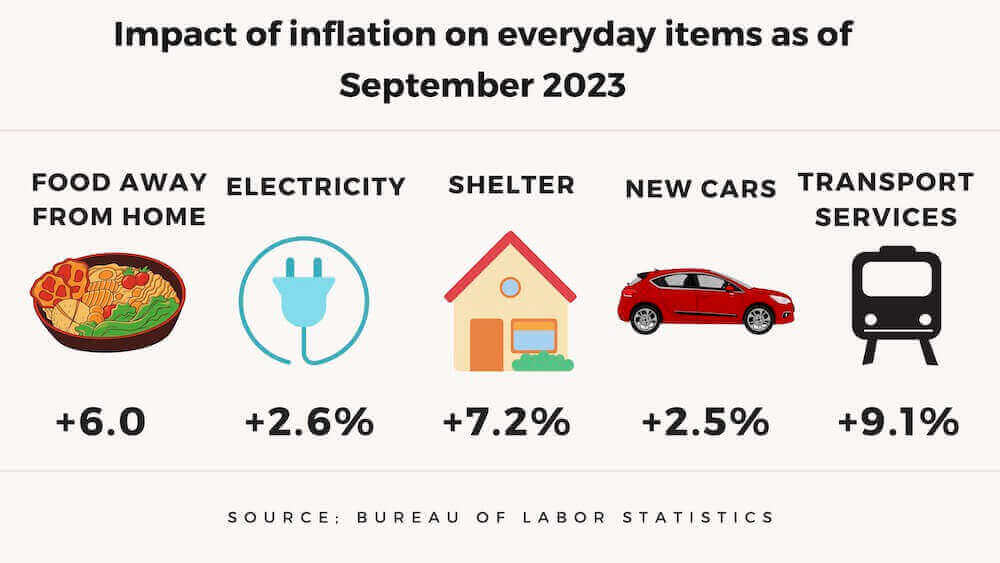

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.5% over the last 12 months to 306.502 (1982-84=100). For the month, the index increased 0.7%, and it also increased by 0.7% in February. The latest figure is 1.7% higher than the average CPI-W for the third quarter of 2023, which was 301.236.

Inflation and Your TSP

FedSmith readers have noticed a significant increase in their Thrift Savings Plan (TSP) accounts as stocks have soared. Part of the reason stock prices set new records is the expectation that the Federal Reserve will reduce interest rates throughout the year to cool the economy and reduce inflationary pressure. Despite these expectations, interest rates have not fallen largely because inflation has not continued to fall.

The argument favoring cutting interest rates by the middle of this year will likely depend on seeing inflation trending down from the second half of last year. Underlying the concern of reducing interest rates is continuing inflation. When CPI data was released in February, core US consumer prices increased by the most in eight months. As a result, the S&P 500 stock market index dropped 1.4%. That was the worst “CPI day” for stocks since September 2022.

The last interest rate hike was on July 26 last year. That hike pushed the fed-funds target rate to between 5.25% and 5.5%—a 22-year high. Stock traders started 2023 expecting several rate cuts throughout the year. These rate cuts, if they occur, will now likely occur later this year.

Where Do Consumers Notice Inflation the Most?

Almost everyone buys groceries regardless of their income level. Grocery prices have gone up faster than the inflation rate since the panic surrounding COVID-19 hit. In the last three years, prices have risen by 19%, but families are now paying 25% or more for groceries than before the pandemic.

Politicians, as expected, often put a smiling face on news that is not necessarily good news, with nuanced statements highlighting favorable events while ignoring the bigger picture. Last month, as an example, President Biden said, “Prices for key household purchases like gas, milk, eggs, and appliances are lower than a year ago. Inflation is down while unemployment has remained below 4% for the longest stretch in more than 50 years.”

That is a true statement ignoring what many people are still facing. Prices for many grocery items are higher now than when he took office. Boneless chicken breasts have increased by 26% since January 2021. White bread per pound is 30% more now compared to January 2021. Butter is now up more than $1 per pound since January 2021.

While most consumers don’t track the cost of individual items, they notice their grocery bills are much higher now. For most, the rise in income is less than the overall price increases.

About Your 2025 Annuity and Social Security COLA

The Senior Citizens League’s latest estimate is that the 2025 COLA will be 2.4%. That is an estimate or a guess as the actual cost of living adjustment applicable in January will not be tallied until mid-October. Depending on inflation as calculated by the CPI-W index, the final result is likely to be higher or lower than the most current estimate.

The annual COLA is calculated by comparing the change in the CPI-W index from year to year based on the average of the third-quarter months of July, August, and September.

It gets much more complicated. To receive the full COLA for 2025, a federal retiree’s annuity or survivor annuity must have started no later than December 31, 2023. If the retirement annuity did not start by this date, the increase is prorated under both CSRS and FERS retirement plans.

Prorated accounts receive one-twelfth of the increase for each month they receive benefits. For example, if the retirement benefit started on November 30, 2023, the prorated COLA would be one-twelfth of the full COLA.

The annual COLA also impacts Social Security benefits. All federal employees who are enrolled in the FERS system are covered by Social Security. These employees contribute to the program at the current tax rate and are eligible for the same benefits as all other workers covered by the program.

For those under FERS, the annuity COLA is different. This chart shows how the annuity is calculated for FERS employees.

| If the CPI is: | Then the COLA is: |

|---|---|

| <= 2% | COLA = CPI increase |

| > 2% and <= 3% | COLA = 2% |

| > 3% | COLA = CPI – 1% |

Inflation Continues to Go Higher

While most people expected inflation to continue going down, that is not happening. Several months of increasing inflation will likely impact the actions of the Federal Reserve and the rising prices will continue to impact consumers in a presidential election year.

While some readers may view a higher COLA and annuity payment as a desirable event, the reality is the continuing increase in prices means the value of the dollar is declining as the cost of goods and services goes up.