I received this question recently from a couple 10 years out from their planned federal retirement dates: “Justin, can we double our TSP accounts in the next ten years?”

This is a good question to explore from a few angles:

- Can they double their accounts in the next ten years?

- Can they do even better?

- What’s the impact on their financial plan?

Background

First, some important context. This family feels they may need around $15,000 a month in today’s dollars to meet their lifestyle goals in retirement. They like to travel and want to be able to support their children and the organizations they care about.

Working to adjust this $15,000 for inflation, we determine this amount will grow to more than $21,000 a month in ten years if inflation averages 3.5% per year.

We have also projected their FERS basic annuity estimates to account for pay increases. We are working with an estimated FERS basic annuity income of $11,000 per month.

Planning for retirement in 10 years when they both turn age 62 also makes them eligible to claim Social Security benefits. However, they are currently planning to delay claiming Social Security income until full retirement age(s) to benefit from the increased payout amounts.

Retirement accounts, investment accounts, and other assets will be required to make up the shortfall of income needed – at least during the gap years between age 62 and full retirement age at 67. The option to claim Social Security any time after age 62 would remain available.

$21,000 income need – $11,000 FERS annuity income = $10,000 shortfall

This couple has been good at contributing to their accounts, but their combined TSP assets of $1.3M aren’t quite enough to generate $10,000 per month at a sustainable withdrawal rate (this would be more than a 9% annual distribution rate).

Being familiar with the 4% rule (strategy) for retirement income withdrawals, they asked, “Can we double our TSP money in the next ten years?”

Many people start feeling the crunch about 10 years out from when they think they’d like to retire. It’s a good time to get serious about projecting retirement income sources that may be available in the future.

Spending Goals in Retirement

For this family, increasing their investment balances is important based on what they would like to spend in their ideal retirement.

They are looking for an additional $10,000 per month in retirement income. By doubling their current portfolio value from $1.3M to $2.6M and applying the 4% rule for withdrawals – this gets them close to the additional monthly income they need.

$2.6M x 4% = $104,000 annual income or $8,666 per month

While this family’s financial situation has some additional complicated layers – they have other assets and plan to incorporate tax diversification strategies both pre and post-retirement – for simplicity, we are just referencing the TSP.

Growing their investments over the next year has a massive impact on their financial plan.

How Long Might It Take to Double an Investment?

The rule of 72 is a simplified investing formula that calculates how long it takes an investment to double its value based on the investment’s rate of return. It’s reasonably accurate, especially for returns between 6% to 10%, and can be especially helpful when contributions are not considered.

It’s important to note this is only a ‘ballparking’ tool and it only applies to investments with fixed returns; if the investment return varies the calculation to double could be very different. We are just illustrating the concept not implying anything more.

The formula looks like this:

72 / rate of return % = time to double

Based on this formula, we can calculate that with a 7.2% rate of return an investment may double in 10 years. We can plug any expected rate of return into the formula – the higher the expected return the shorter the time period to double the hypothetical value.

Helpful, yes, but we plan to continue to make contributions over the next 10 years, especially since they are likely to continue to be peak earnings.

What we are after in the next ten years is increasing the value of a TSP account (or all of our accounts) with investment returns and contributions.

Doubling the account value may just be an arbitrary point for most, but the main idea is that we can potentially make significant progress in growing our investments over a ten-year period by considering both:

- Investment contributions

- Return on investment

It’s also true one of these things is in your control while the other is not.

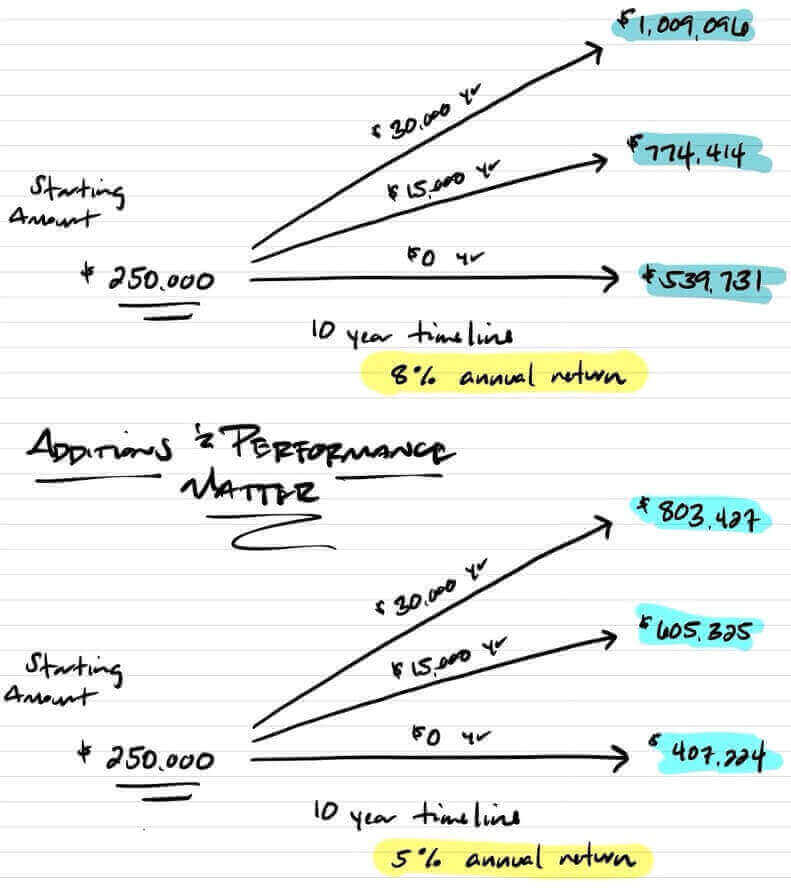

Let’s look at the impact on potential account values with varying contribution amounts and returns in this hypothetical example:

How far can we get in the next ten years?

The opportunity is significant, to try to produce results focused on:

- Making account contributions

- Investing properly for market returns

- Creating a clear picture of your goals

Each of these items matters if you are trying to go farther.

I hope you’ve found this information on retirement income helpful. I would encourage you to take the time to review all your investment allocations and contribution amounts so you can make the best decisions for your circumstances.

I also publish a biweekly newsletter with insights into topics like this and more. If you’d like to join the list, please subscribe here.

Don’t be afraid to ask questions. I’m here to help.

The content is developed from sources believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.