The TSP (Thrift Savings Plan) is the largest employer sponsored savings plan in the world and it plays a huge role (or at least should) in the retirement of every FERS federal employee.

Thousands of millionaires are made every year just from effectively using their TSP account.

But honestly, unless someone has at least a basic knowledge of the TSP Funds then it is very difficult to be successful in the TSP long term.

This article will get you up to speed fast on the basics of the fund options in the TSP.

The Essentials

There are only 5 core fund options in the TSP. Here they are with a brief explanation of what they invest in.

- G Fund: Invests in U.S. Treasury Bonds. .

- F Fund: Invests in various types of U.S.-based bonds.

- C Fund: Invests in 500 of some of the largest U.S. companies (Tracks the S&P 500).

- S Fund: Invests in most other major U.S. companies excluding the S&P 500.

- I Fund: Invests in the major companies in Europe, Australasia, and the Far East.

Note: There are also L funds in the TSP, but these funds are just a mixture of the core 5 funds. I’ll discuss the L funds more below.

To keep things simple, I am going to break the TSP funds into 2 categories: aggressive and conservative.

The Conservative Funds

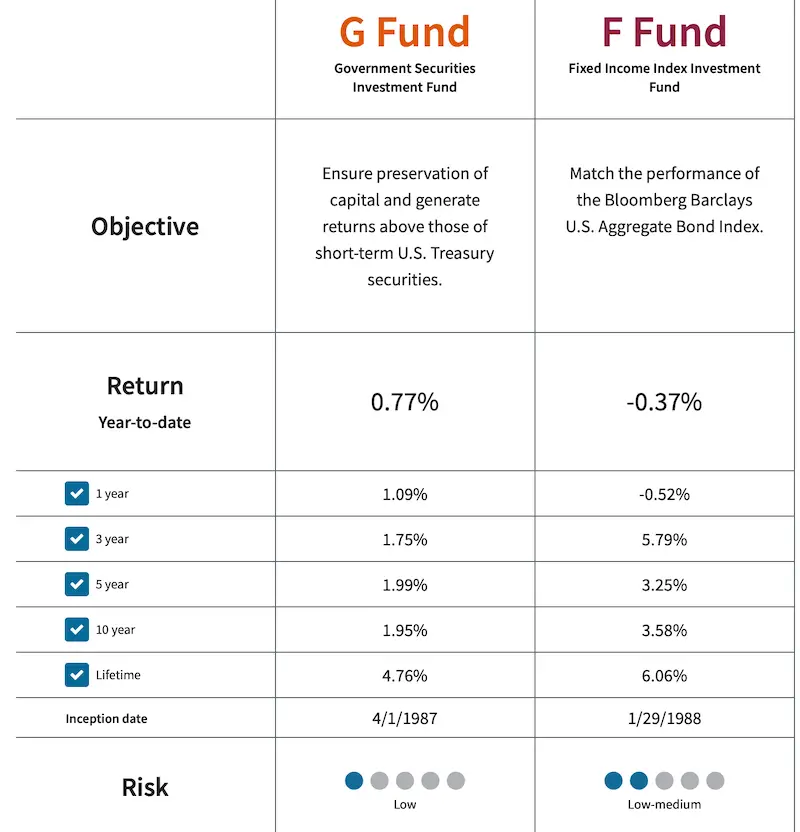

The G and F funds are the more conservative of the 5 funds because they don’t have the tendency to be as volatile as the others, but as a price for being more stable, they don’t have the potential to grow like the other funds do.

The G fund actually guarantees that any money invested in it won’t lose value, but it has only averaged about a 2% annual return over the last 10 years.

The F fund can drop in value but is still very stable compared to the other funds. It has averaged about 3.6% annual return over the last 10 years.

Here is a chart showing the return of these 2 funds over different periods as of 8-11-21:

As you can see, the F fund has decreased slightly in value over the last year primarily because of low interest rates.

The Problem With The G and F Funds

As many people approach retirement, they often will put the majority of their TSP accounts into a combination of the G and F funds. While putting a portion of your money in conservative funds can be a very strategic thing, many people take this way too far.

The G and F funds probably won’t lose value, but they probably won’t grow much either. Overtime, this lack of major growth as well as inflation can take a huge toll on your money.

For instance, if the prices of things go up every year (inflation) and your investments aren’t growing enough to more than make up for it, then you may deplete your TSP much faster than you had planned.

Now I am not saying that the G and F funds aren’t good funds. They are great funds and they do exactly what they are designed to do. But with that being said, you will want to make sure you also have investments that will help you maintain your standard of living over the course of your entire retirement.

The Aggressive Funds

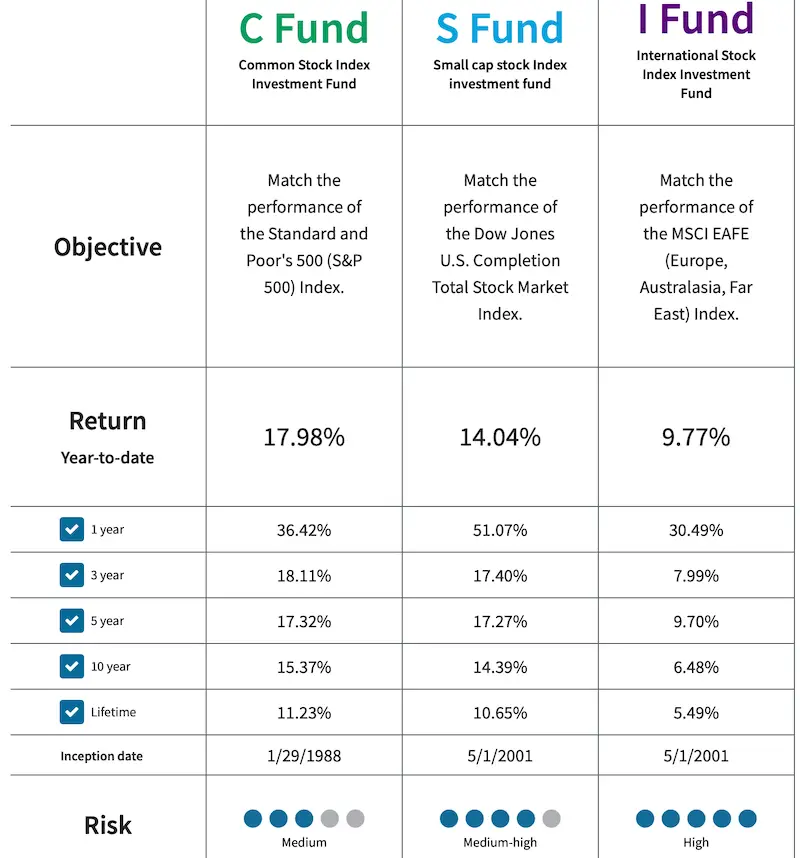

The C, S, and I funds are the more aggressive of the funds in the TSP.

The reason they are called “aggressive” is because they have a much higher chance of sustaining major growth over time. But because of this, they can also be much more volatile than the G and F funds.

For example, the C fund lost more than 35% in 2008 but regained it all and more in the next couple of years.

You shouldn’t invest any money into these funds that you are going to need in the next few years. These funds will perform better in the long term but are not as predictable in the short-term.

Here is a chart showing the return of these 3 funds over different periods as of 8-11-21:

The L Funds

The most important thing to understand about the L funds is that they are not independent funds. They are simply different combinations of the core 5 funds that we have been talking about.

What makes them different, however, is that each L fund is designed to automatically become more conservative over time. In theory, one could invest in a single L fund and never have to change their investment allocation for the rest of their career.

In practice, I don’t think they work really well, and here are 2 articles that I wrote previously digging deeper into my thoughts.

Final Thoughts

Now I hope you have a better understanding of the different TSP funds and what they are designed to do, and now when you watch/read my other content about investment strategies you will be much more prepared to understand why I am recommending what I am recommending.