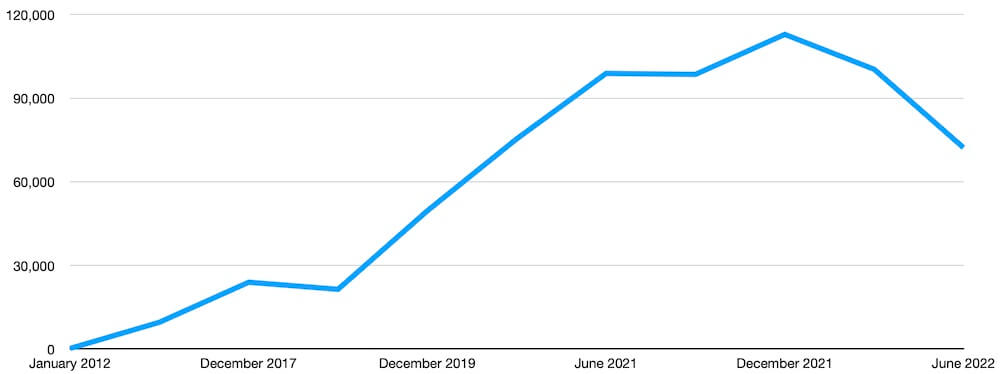

As the stock market goes up, one would expect the number of TSP millionaires to go up, and the number of them in the Thrift Savings Plan (TSP) has gone up significantly over the years.

As of the end of December 2021, there were 112,880 TSP investors who were members of the TSP millionaires club. That was a new high number in this elite group of TSP investors. A big contributor to this (at the time) increasing number of millionaires was the annual return for the TSP’s C Fund and S Fund. In 2021, the C Fund had a return of 28.68% while the F Fund had a return of 12.45%. That return was on top of an 18.31% C Fund return in 2020 and an S Fund return of 31.85%.

At the other end of the stock market cycle, we can expect the number of TSP millionaires to go down in number as stocks drop. These expectations have again been met as the latest report shows a significant decline in the number of TSP millionaires since the end of December 2021.

In comparison to the magnificent returns cited above in 2020 and 2021, the C Fund has a return of -12.24 while the S Fund is down -18.59% as of August 5, 2022. There is obviously a direct correlation between how the stock market performs and the value of a person’s TSP fund.

The result of the drop is that when there were more TSP millionaires in December 2021, about 3% of TSP investors fell into the millionaire category. Now, about 1.7% qualify for the title.

We do not know, of course, how the stock market will perform for the remainder of this year.

36% Decrease in TSP Millionaires Since December 2021

TSP Millionaires: Highs and Lows

The number of millionaires in the TSP dropped to 100,364 by March 31, 2022 (the end of the first quarter of 2022). As there were 112,880 TSP millionaires at the end of December 2021, the drop in Q1 2022 was a decline of 11%.

The number dropped again as of June 30th. There are now 72,241 TSP millionaires. This means the number of millionaires in the TSP has now dropped by 36% since the high point on December 31, 2021. The new number is the lowest number of millionaires since 2020 when there were 75,420 TSP investors in the category of “TSP millionaires”.

Here is a quick summary of how many TSP millionaires there are in the program.

| January 2012 | 208 |

| December 2016 | 9,599 |

| December 2017 | 23,962 |

| December 2018 | 21,432 |

| December 2019 | 49,620 |

| December 2020 | 75,420 |

| June 2021 | 98,879 |

| September 2021 | 98,523 |

| December 2021 | 112,880 |

| March 2022 | 100,364 |

| June 2022 | 72,241 |

At the end of June 2022, there were 6,649,749 total participants in the TSP program. At that time, the TSP assets were almost $707 billion.

At the end of December 2021, there were 6,521,753 total participants in the TSP. Total TSP assets at that time were almost $812 billion.

As the stock market has dropped, the total TSP assets have dropped, the number of participants has gone up, and the number of millionaires has also dropped.

How Does Your TSP Balance Compare to other Investors?

The number of TSP millionaires is a relatively small number out of the total number of participants in the program. As one might expect, the largest number of TSP investors are in the “under $50,000” category of investors. On the other hand, one TSP investor now has $6,955,938.72 in an account. That compares to the largest amount for any TSP investor standing at $10,975,527 in December 2021. We do not know if these two investors are the same person or different people.

In either case, the stock market drop has taken a toll on overall account balances in the TSP.

Here is how many TSP investors there are in several breakpoints of TSP account balances.

TSP Account Balances

| Account Balance | Number of Participants |

| < $50,000 | 4,160,558 |

| $50k – $249k | 1,621,153 |

| $250-$499k | 519,397 |

| $500k-749k | 193,326 |

| $750-999k | 85,444 |

| $1 million | 72,241 |

| Total | 6,652,119 |

Our congratulations to all 72,241 TSP millionaires. Having this much in a TSP account in the midst of the current economic situation is no small matter.

While inflation is up substantially over the past twelve months, the value of stocks is down as a result of a falling market. While politicians argue over the “real” definition of a recession, most Americans know the value of our investments is down substantially, while the purchasing power of a salary check, retirement annuity, Social Security Payment, or value of dollars withdrawn from the TSP have all gone down.