The end of the year can be quite busy when it comes to your finances. There are many financial advantages that a family can gain at this time of year. Most people focus on tax saving strategies, which is a big part of it, but saving on taxes is only one of several important ones in a checklist of tasks.

In this article, we’ll review our financial checklist that you can do prior to the year ending to help strengthen your financial position.

Review Your Plan

Take this time to review if you are still on track for your goals, be them retirement, buying another home, funding your children/grandchildren’s education, etc. A good plan is always changing and adjusting to meet the needs of the family it serves.

Ask yourself things like: have I saved as much as I thought I would this year? Have I saved as much as my plan calls us to? Have my priorities or timelines changed?

Your plan may need to be adjusted based on variables in the world or in your life.

Review Portfolio Contributions

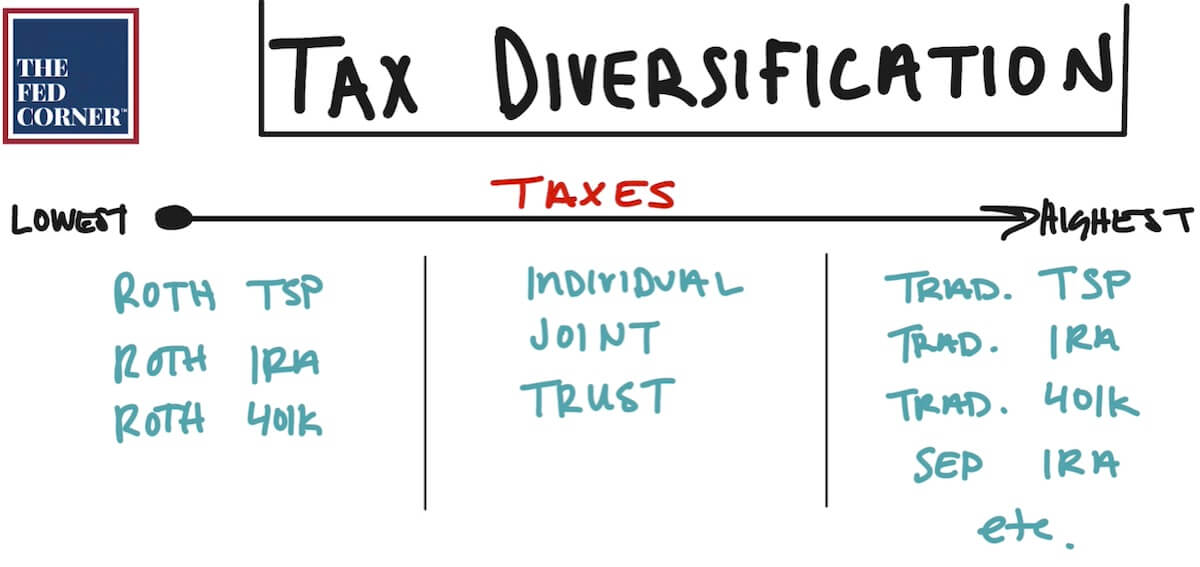

Are you saving after-tax dollars to diversify your taxability in retirement? You don’t want to only have pre-tax money like Traditional TSP, IRA, or 401K dollars. You need some after-tax dollars too or risk being forced into higher tax brackets during RMD years.

Every dollar out of Traditional retirement accounts is 100% taxable at ordinary income rates. This is the highest form of tax. RMDs accelerate your dollars coming out of your traditional retirement accounts. This acceleration could push you into high tax brackets. Planning early enough may allow you to save significant amounts of money in reduced taxes over your lifetime.

Are you maxing out your TSP? Limits change each year, make sure you’re putting in as much as you can.

Did you turn 50 and can now do catch-up contributions? Make sure you adjust your retirement account contributions to the higher amounts.

Are you taking advantage of doing IRA contributions as well? While it may not be deductible, it’s still money that grows tax deferred.

Conduct Your Annual Year-End Tax Review

Keeping track of your income projections allows you to keep a careful pulse on your taxes and minimize your tax liability. How close are you to your income projections? If you recently just retired, do you have room for Roth conversions?

Does it make sense to accelerate or defer certain deductibles and tax benefits? Maybe bunching your deductions is smart. Maybe it isn’t. These are questions you need to be asking yourself and your professionals.

Explore tax-loss harvesting and tax-lot swaps. This is a big one. This year has offered tremendous opportunity for tax savings. If you’d like more info, check out our other articles and videos on the topic.

Assess Your Investment Strategy

Throughout the year, portfolios change in value which shifts your asset allocation. This is called “Portfolio Drift.”

Is your asset allocation still appropriate for your financial and retirement plan? Is it still appropriate relative to the economy and markets? What changes do you need to make? You should be rebalancing more regularly than yearly, especially in taxable accounts. If you haven’t addressed your portfolio this year, now is your chance.

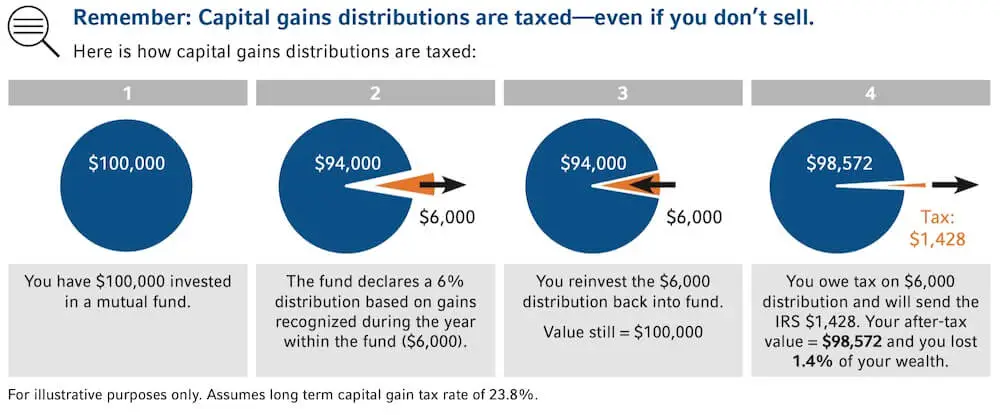

Assess capital gains. If you hold mutual funds in individual or joint accounts, or even trust accounts, you may be faced with hefty tax bills. This is because imbedded gains in those mutual funds will be passed onto you as the investor.

Take the time to utilize more tax-efficient investments when rebalancing, like ETFs. This may help you have a better portfolio for the years going forward.

Review Charitable Contributions

If you do any donations at year-end, consider whether a DAF or bunching your donations makes sense. If you don’t know what that is, I encourage you to watch the tax savings video we did and read the affiliated article.

If you’re of age, consider using QCDs for your donations. It counts towards your RMD, and you don’t pay any taxes while helping a charity. Everybody wins. Just make sure the charity is qualified.

Perform RMDs

This one is easy: do it if you have to, the penalties for missing it are steep. But consider whether you may be leaving money to your kids one day, and whether you’re in a lower tax bracket than they will be when they inherit from you.

Perhaps you might wish to take more out and pay the taxes now at your tax rates than leaving it up to them at a possibly higher tax bracket.

Review Beneficiaries and Estate Plan

Take this time to do a full review of your beneficiaries and legal documents. If you moved, bought new car or new home, if people were born, died, joined your life, left your life–this may change your beneficiary designations and your legal documents.

Review Insurance Needs

Are you properly insured? Under or over-insured? Insurance needs change as your life changes, so you need to make sure you have enough or aren’t buying more than you need.

Life insurance, health insurance, long term care, liability and umbrella, property and casualty. There are a lot of them, make sure you address your needs for all.

Regular planning helps you stay on top of these factors and allows you to maximize your results. Make sure you don’t view any as a siloed element, rather multiple parts of a singular entity as your family’s financial health.