A new glide path implemented by the Federal Retirement Thrift Investment Board (FRTIB) over the last few years will help to shape the Thrift Savings Plan (TSP) L Funds and the retirement savings of federal employees who invest in them for years to come.

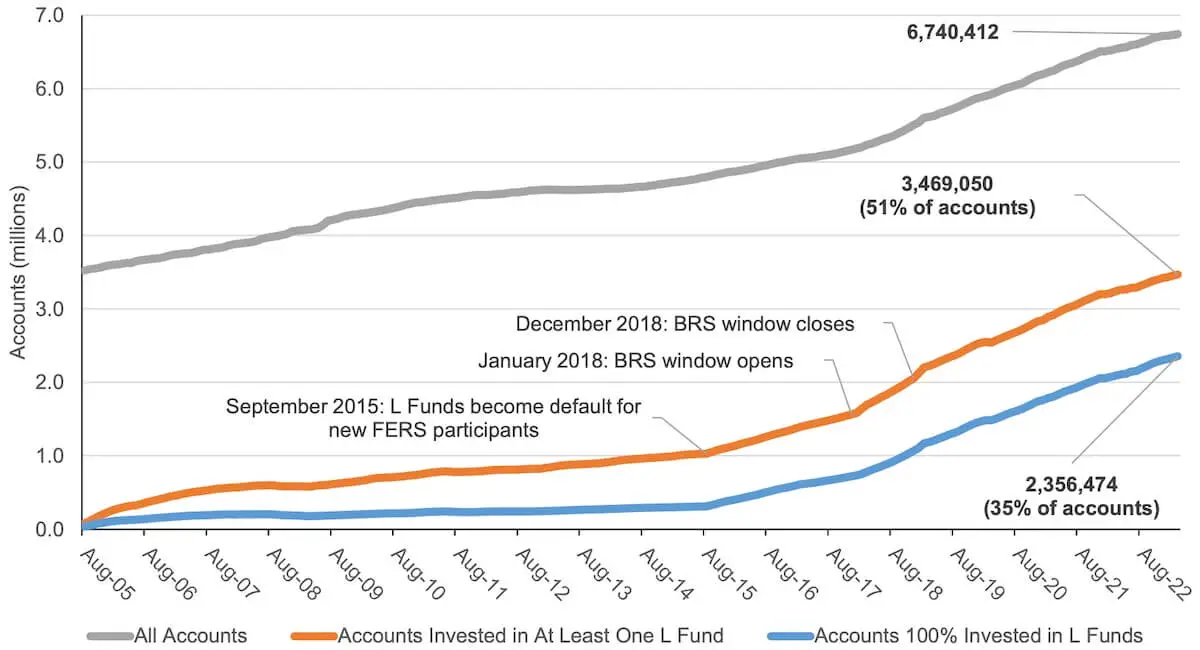

L Funds Growing in Popularity

The FRTIB said in its latest monthly meeting that the L Funds have been growing in popularity. Approximately 51% of all TSP accounts have at least some assets in the Lifecycle Funds (L Funds). Moreover, more than one-third of TSP participants have 100% of their assets in the L Funds.

What is a glide path?

A glide path is a type of strategic plan for allocating investments. According to Investopedia.com, “Glide path refers to a formula that defines the asset allocation mix of a target-date fund, based on the number of years to the target date. The glide path creates an asset allocation that typically becomes more conservative (i.e., includes more fixed-income assets and fewer equities) as a fund gets closer to the target date.”

In the case of the TSP, the glide path is the strategic plan for allocating the retirement investments of federal employees who are investing in the L Funds.

“The glide path leads the L Funds to a reduction in risk over time towards a terminal point where the risk targets for asset allocations are intended to be permanently set,” said Sean McCaffrey, Chief Investment Officer at the FRTIB.

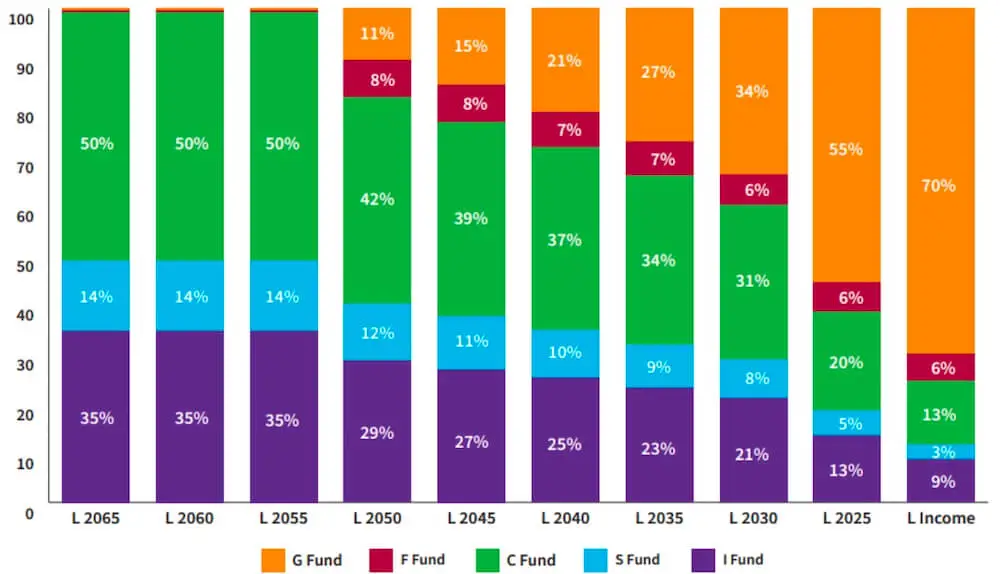

Less than 1% of the L 2065, L 2060, and L 2055 Funds is invested in the G and F Funds. Due to rounding, numbers may not add up to exactly 100%.

This chart showing the allocations of assets in the L Funds helps illustrate this. On the lefthand side, the L Funds with target retirement dates further into the future are almost exclusively invested in the TSP’s stock funds (C, S and I Funds), but as it moves farther towards the righthand side of the chart, the weighting goes much more heavily towards the fixed income investments in the TSP (the G and F Funds).

When an L Fund reaches its termination date, its assets are rolled into the L Income fund. This TSP fund has the most in fixed income investments.

The FRTIB noted in its most recent monthly meeting that the L Income fund is in the process of transitioning to a higher stock allocation target of 30%, and the agency plans to hold it at this amount. Therefore, it will be fixed at 30% stock funds (C, S, and I) and 70% fixed income funds (G and F).

Regarding the L Funds, the TSP states on its website, “One of the important things about the L Funds is that they stick to their target allocations for a full quarter regardless of what the markets do.”

It further states:

Every quarter (three months), the target allocations of all the L Funds except L Income are automatically adjusted, gradually shifting them from higher risk and reward to lower risk and reward as they get closer to their target dates. When an L Fund reaches its target date, it goes out of existence and any money in it becomes part of the L Income Fund, which generally keeps the same target allocation. For example, in 2025, the L 2025 Fund will be rolled into the L Income Fund.

New Glide Path Shaping Direction of the L Funds

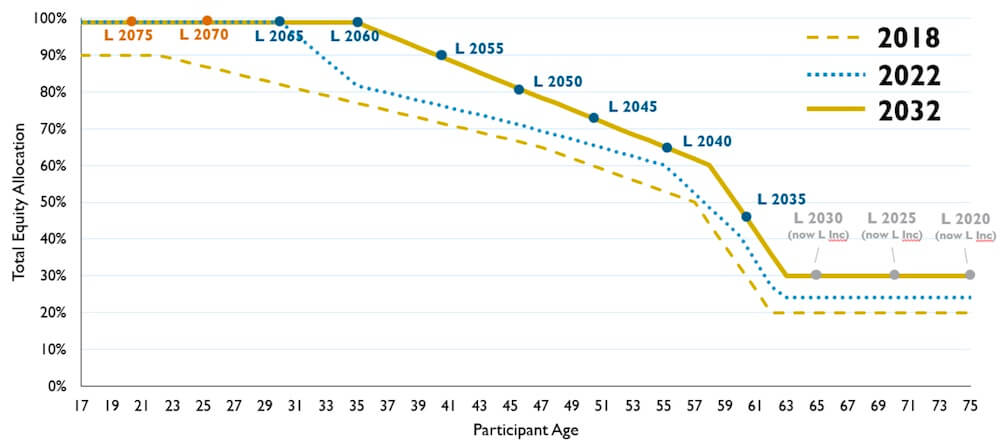

The FRTIB also said in its most recent meeting that it has made changes over the last few years which have resulted in a shift of the L Funds glide path.

Previously, there was a lower allocation to the TSP stock funds. Even at the dates farthest from retirement, the total stock fund allocation was 90%, and it bottomed out at 20% when closer to retirement age. Also, the terminal point of the glide path was age 62.

As of 2020, the L Funds now have higher allocations to the TSP stock funds. For the funds furthest away from their target retirement dates, the allocation to stocks will be 99%, and will bottom out at 30% in the most conservative allocation. The glide path terminal point is also one year later (age 63 instead of age 62).

This graphic illustrates the changes. The dotted gold line represents the old glide path, and the solid gold line represents the new glide path.

TSP L Funds Glide Path Transition (2018-2032)

The FRTIB cited these reasons for the change in the L Fund glide paths:

- The intervals of 10 years were deemed inadequate for customization needed of TSP participants and was not in line with industry standards. Consequently, the L Funds now have five year target date intervals.

- With the advent of the Blended Retirement System, many new recruits were coming in who were only at the beginning of saving for retirement.

- Data indicated that TSP participants typically start withdrawing from the TSP at age 63.

- There is greater recognition that retirement assets have to last longer after participants retire as people live longer.

“We think these changes overall have put our participants in a better position to generate favorable financial outcomes at retirement,” said McCaffrey.

He also noted that the long transitions that were put in place were done to help minimize disruption for current TSP participants who already own L Funds as well as to also ensure that there was proper time for communications and to reduce possibilities for mistiming the planned increase in stock allocations.