Why Did TSP Performance Suffer? Focus on Debt Ceiling

How will the American leaders in government resolve the debt ceiling debate?

That question has been dominating much of the market activity due to the uncertainty of the issue. While most probably expect the issue to be resolved, investors have been nervous about the possibility of the dispute lingering, and it has had an impact on recent stock market returns.

There is also uncertainty about how the Federal Reserve will react to the latest economic news. Concern about the Federal Reserve continuing to raise interest rates and fear of a recession have influenced investor actions.

Last night, the House of Representatives passed a bill that would suspend the federal government’s debt ceiling and require the government to make some spending cuts. The vote in the House was 314-117. The final vote received support from both Republicans and Democrats. The bill now goes to the Senate for a vote.

Seventy-one Republicans voted against the bill with concerns that the deal does not cut enough spending and will add $4 trillion to the national debt. 165 Democrats in the House voted in favor of the bill.

House Speaker Kevin McCarthy, commenting on the negotiating process, said, “This negotiation blew up a number of times, where I wasn’t sure at times we were going to get something. There were times that one side will say to the others, maybe we need to give up. Maybe we have to have somebody else different in the room. But the one thing that happened is that we didn’t give up.”

May TSP Performance Disappointing, But C and S Funds Show Positive Results

With this background, Thrift Savings Plan (TSP) investors watching their investments in May and hoping for a significant upturn in TSP stock funds will be disappointed with the monthly TSP performance.

Two TSP stock funds had a positive return last month. The C Fund had a return of 0.43%, and the S Fund had a return of 0.44%. Other than the G Fund (0.31%), all of the TSP Funds were down for the month.

The biggest loser in May was the I Fund. It declined 4.01% during the month. Last month, in reporting on the TSP results for the year, we noted “the I Fund is ahead of every other fund in the Thrift Savings Plan (TSP). For April, it gained 2.87%. For the past 12 months, it gained 10.19%. So far in 2023, it has gained 11.74%.”

That is no longer the case. The I Fund is still up 7.26% for the year and 4.52% for the past 12 months, but its year-t0-date returns now lag behind the C Fund. The 12-month returns for the I Fund are still the highest of any TSP Fund.

TSP Returns for May 2023, 12 Months and Year-to-Date

| Fund | May 2023 | Year-to- Date | 12-Months |

|---|---|---|---|

| G Fund | 0.31% | 1.59% | 3.73% |

| F Fund | -1.10% | 2.62% | -2.44% |

| C Fund | 0.43% | 9.63% | 4.79% |

| S Fund | 0.44% | 4.00% | -2.07% |

| I Fund | -4.01% | 7.26% | 4.52% |

| L Income | -0.12% | 3.29% | 3.92% |

| L 2025 | -0.30% | 4.22% | 3.62% |

| L 2030 | -0.63% | 5.64% | 3.99% |

| L 2035 | -0.72% | 6.02% | 3.91% |

| L 2040 | -0.81% | 6.40% | 3.85% |

| L 2045 | -0.89% | 6.72% | 3.76% |

| L 2050 | -0.96% | 7.03% | 3.71% |

| L 2055 | -1.12% | 8.04% | 3.92% |

| L 2060 | -1.12% | 8.04% | 3.91% |

| L 2065 | -1.12% | 8.04% | 3.91% |

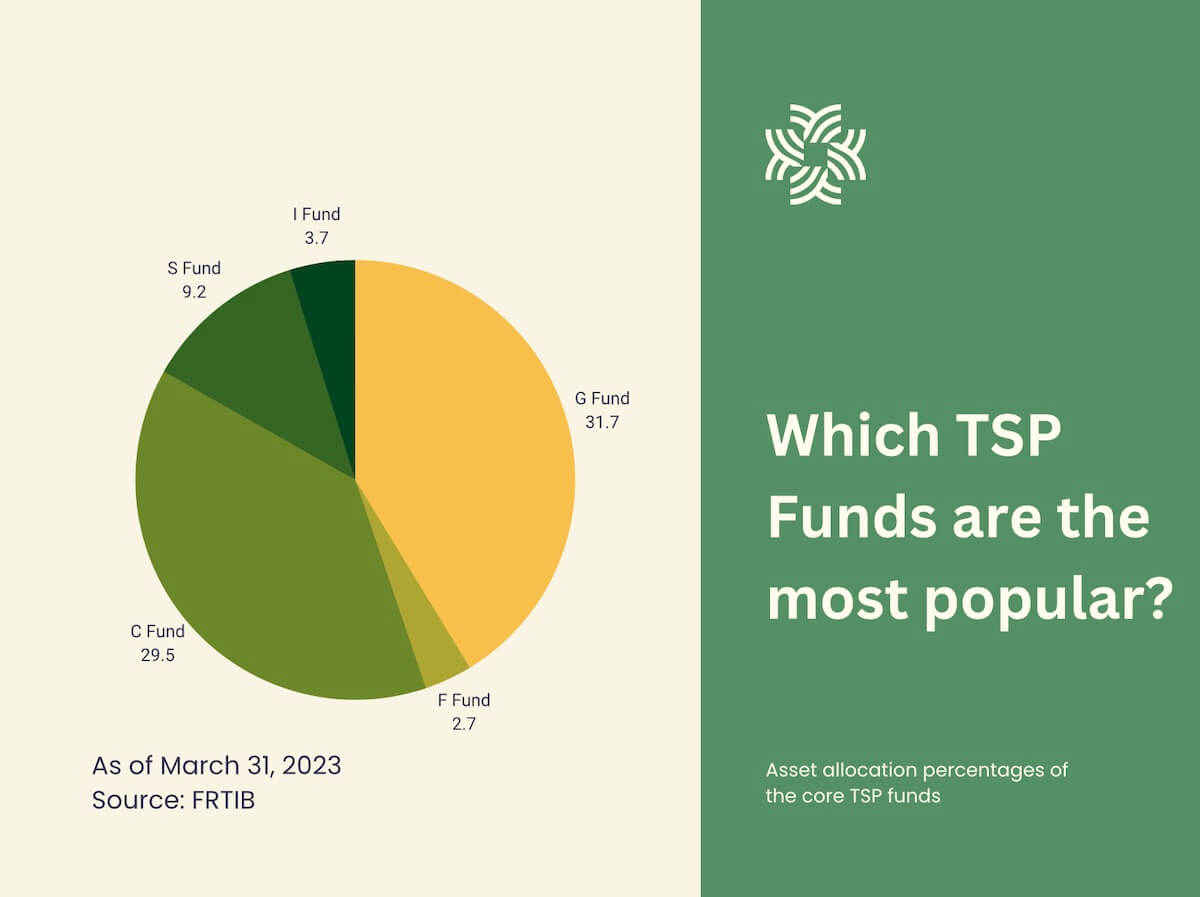

Average TSP Balances

Total TSP assets were up to $780 billion at the end of March. Here are the average TSP balances for FERS and CSRS investors.

| Number of Accounts | Average Balance | Number of Roth Accounts | Average Roth Balance | |

| FERS | 3,926,444 | $163,421 | 944,559 | $23,249 |

| CSRS | 259,926 | $181,465 | 9,612 | $30,962 |

| BRS | 1,241,467 | $11,379 | 747,726 | $9,838 |