The OPM retirement backlog fell sharply in May 2023 to its lowest level so far this year.

The backlog of retirement claims at the Office of Personnel Management fell 11% in May, thanks to the agency processing 37% more retirement claims during the month than it received. May was the second month in a row that the OPM retirement backlog dropped by 11%. OPM received 6,096 new retirement claims last month but was able to process 18,125.

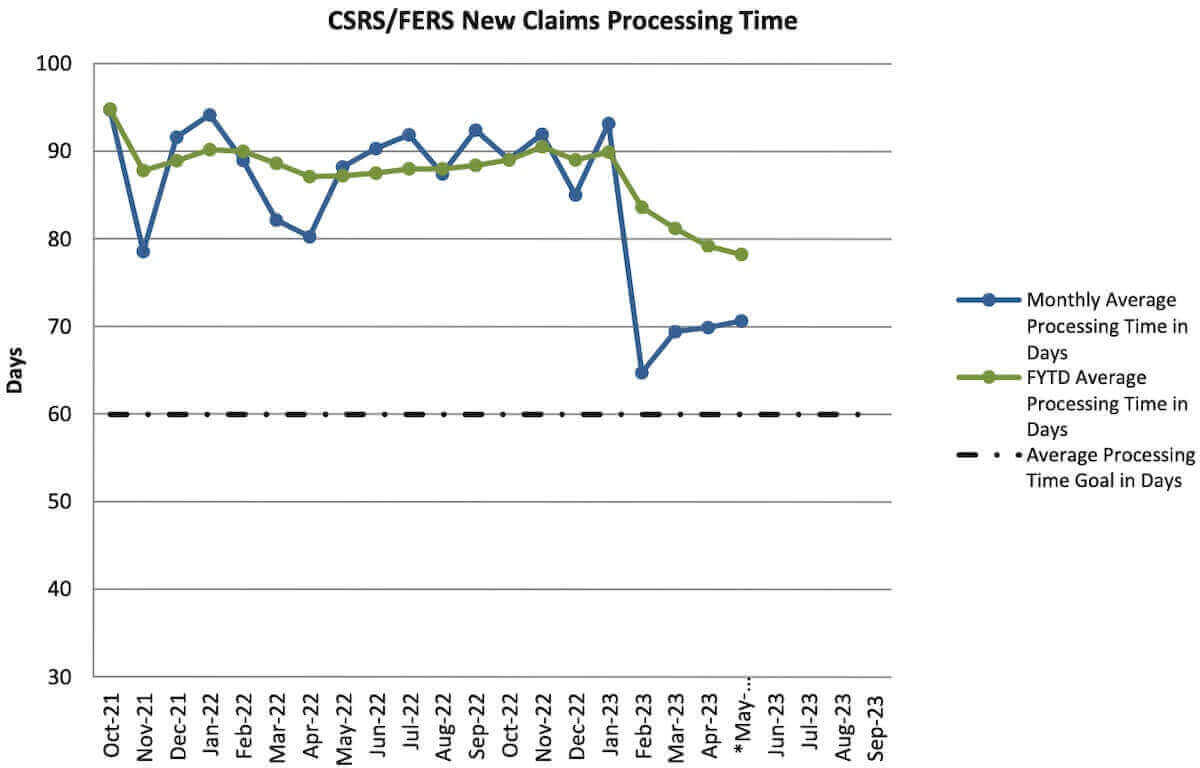

Retirement claims took an average of 71 days to process in May. OPM’s target time for processing voluntary retirement applications is 60 days. It can take longer in some cases, such as if OPM needs additional information or if the case has special circumstances, like applying under disability provisions, a specific retirement law (LEO, FF, or ATC), or evaluating a court order.

The OPM retirement backlog has declined sharply so far in 2023. The year began with the usual spike in new claims to kick off the year when 12,404 new claims came in during January. This pushed the OPM retirement backlog up to 24,858. Since that time, it has fallen 27%, reaching its lowest level of the year so far at the end of May.

OPM’s Efforts to Reduce the Retirement Claims Backlog

OPM’s stated goal for the retirement backlog is 13,000, and the agency has been working hard this year to achieve that figure.

Lori Amos, Deputy Associate Director for OPM’s Retirement Services, recently commented on the progress made so far in 2023 on reducing the total number of outstanding retirement claims.

“We are pushing as hard as we can to get to that 13,000 number,” said Amos. “We have projections for certain months, but we don’t know when people choose to retire, so that number is based on the number of receipts [new retirement claims] versus the number of cases that we process and adjudicate. We are hopeful that we can get that number employing the process changes that we have made and the tools that we are using.”

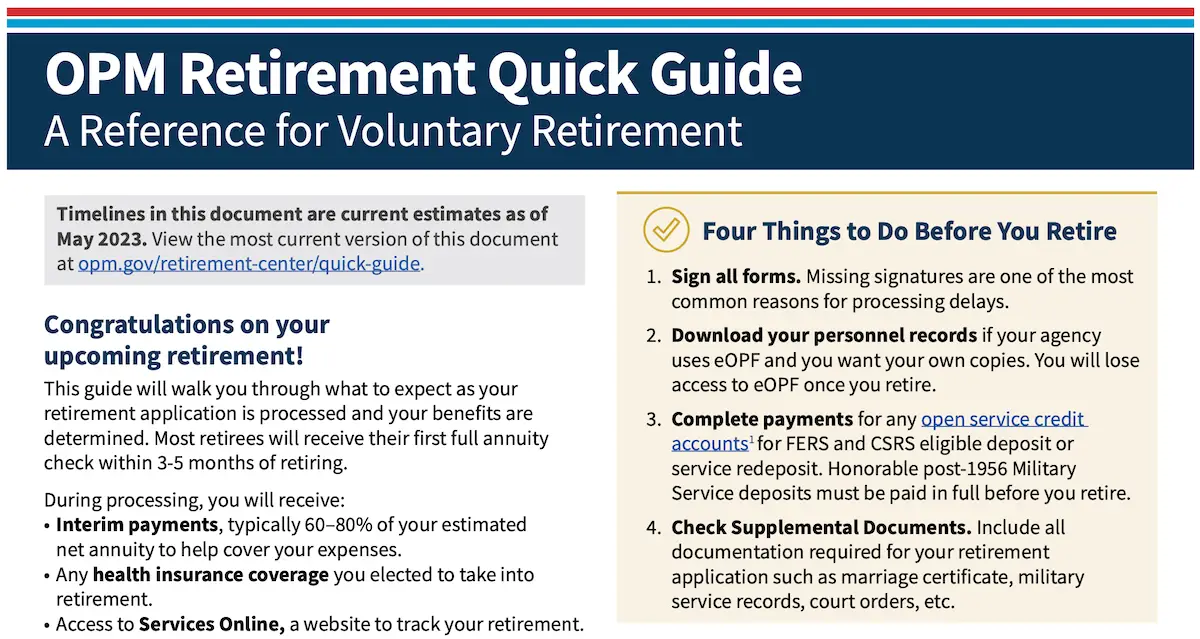

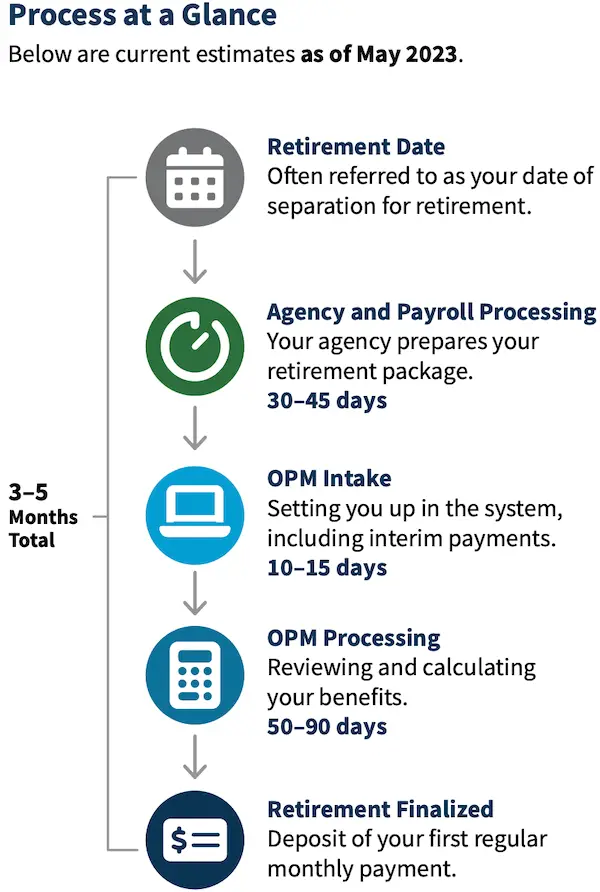

One of the new tools Amos was referring to is the new OPM Retirement Quick Guide that launched in May. It is a simple, three-page guide that will walk federal employees through what to expect as a retirement application is processed and benefits are determined, including helping federal employees estimate when they can expect to receive their interim and first annuity payments.

Among the features of the new guide are an outline of the steps in the federal retirement process and an estimate of how long each one is expected to take based on the current month. OPM will be updating this part of the guide each month based on the current trends in the incoming retirement claims and the processing status.

“This guide is our attempt to improve customer experience,” said Amos. “We have put a lot of work, time, and effort based on feedback that we have received from our retiree community. Our goal is to be able to give [federal employees and retirees] information about the voluntary retirement process.”

She added, “We want feedback, and we want to know how we can improve it.”

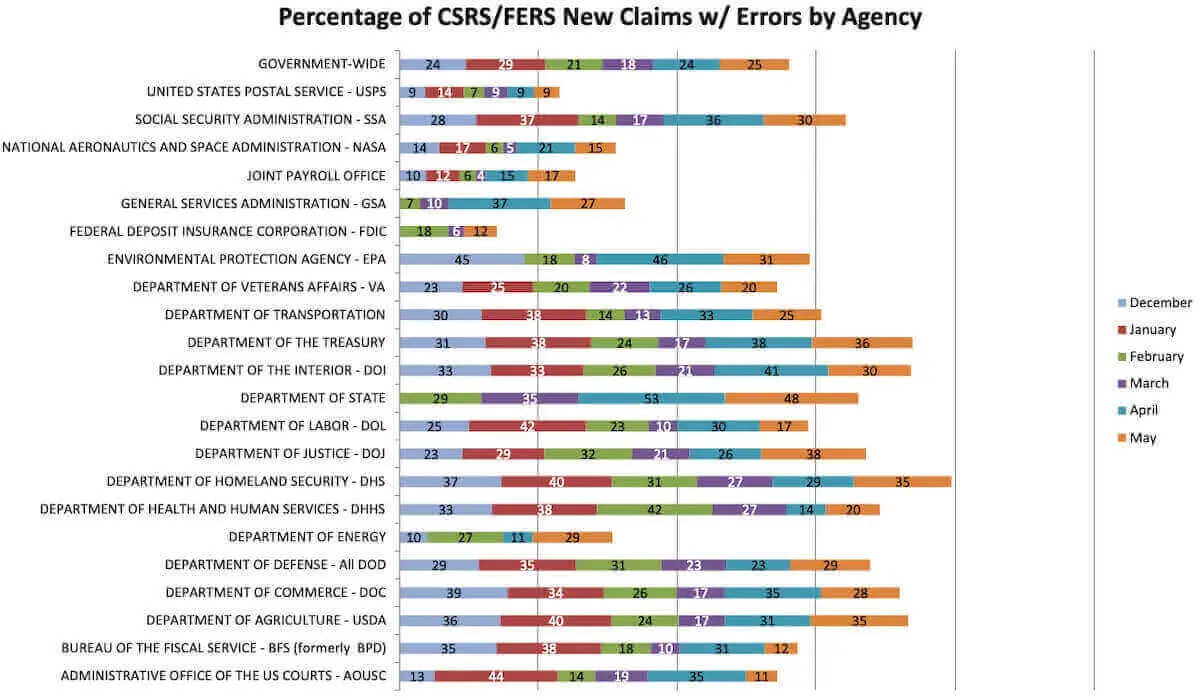

Which Federal Agencies Have the Most Errors on Retirement Applications?

Errors in retirement applications are the most common culprit in delaying the processing of federal employees’ retirement applications, something else that OPM hopes the new OPM Retirement Quick Guide will help to reduce.

Compared to last month, the percentage of cases with errors declined somewhat among the agencies listed.

The State Department remained in the top spot, a position it has held since March.

According to OPM, these are the agencies that have the highest percentages of errors on non-disability retirement application packages:

| Agencies | % of Cases With Errors |

|---|---|

| Department of State | 48 |

| Department of Justice | 38 |

| Department of Treasury | 36 |

| Department of Agriculture | 35 |

| Department of Homeland Security | 35 |

These agencies collectively have the fewest retirement application errors according to the May data:

| Agency | % of Cases With Errors |

|---|---|

| United States Postal Service | 9 |

| Administrative Office of the US Courts | 11 |

| Bureau of the Fiscal Service | 12 |

| Federal Deposit Insurance Corporation | 12 |

| National Aeronautics and Space Administration | 15 |

The governmentwide error rate was 25% as of the end of May 2023. It has increased for three months in a row now (18% in March, 24% in April and 25% in May).

OPM Retirement Backlog Processing Status – May 2023

| Month | Claims Received | Claims Processed | Inventory (Steady state goal is 13,000) | Monthly Average Processing Time in Days | FYTD Average Processing Time in Days |

|---|---|---|---|---|---|

| Oct-21 | 8,006 | 10,711 | 26,105 | 95 | 95 |

| Nov-21 | 8,266 | 8,010 | 26,361 | 79 | 88 |

| Dec-21 | 7,569 | 7,200 | 26,730 | 92 | 89 |

| Jan-22 | 13,266 | 8,689 | 31,307 | 94 | 90 |

| Feb-22 | 12,241 | 8,124 | 35,424 | 89 | 90 |

| Mar-22 | 10,042 | 9,117 | 36,349 | 82 | 89 |

| Apr-22 | 9,983 | 11,393 | 34,939 | 80 | 87 |

| May-22 | 7,673 | 10,266 | 32,346 | 88 | 87 |

| Jun-22 | 6,032 | 7,935 | 30,443 | 90 | 88 |

| Jul-22 | 9,487 | 10,706 | 29,224 | 92 | 88 |

| Aug-22 | 8,032 | 8,019 | 29,237 | 87 | 88 |

| Sep-22 | 8,086 | 10,681 | 26,642 | 92 | 88 |

| Oct-22 | 6,423 | 7,838 | 25,227 | 89 | 89 |

| Nov-22 | 6,064 | 7,442 | 23,849 | 92 | 91 |

| Dec-22 | 5,490 | 7,743 | 21,596 | 85 | 89 |

| Jan-23 | 12,404 | 9,142 | 24,858 | 93 | 90 |

| Feb-23 | 9,562 | 10,920 | 23,500 | 65 | 84 |

| Mar-23 | 8,354 | 8,929 | 22,925 | 69 | 81 |

| Apr-23 | 8,298 | 10,839 | 20,384 | 70 | 79 |

| *May-23 | 6,096 | 8,355 | 18,125 | 71 | 78 |

Disability determinations are included in the pending number after approval. Average Processing Time in Days represents the number of days starting when OPM receives the

retirement application through final adjudication.

*Initial retirement cases produced in less than 60 days, on average took 37 days to complete; whereas cases that were produced in more than 60 days, on average, took 117 days to complete.