Two bills recently introduced in Congress would ban environmental, social, and governance (ESG) funds from being used for investing federal employees’ retirement savings within the Thrift Savings Plan (TSP).

The No ESG at TSP Act was introduced in the Senate (S. 2147) by Senator Mike Lee (R-UT) and in the House (H.R. 3612) by Congressman Chip Roy (R-TX).

Roy introduced the bill before, shortly after the mutual fund window launched in 2022. He said in a statement at that time:

ESG investing is a woke scam. It restricts the free flow of capital, undermines U.S. energy freedom to the benefit of our enemies, and advances woke racial and gender ideologies intent on dividing the republic. The upcoming changes to TSP would allow billions of taxpayer dollars to serve these ends. The federal government shouldn’t have any part in this radical nonsense, and especially shouldn’t be using your money to do it.

In an updated statement issued upon release of the 2023 bill, Roy said:

ESG is an investing scheme woke corporations are using to appease the Left by destroying reliable American energy and advancing radical gender and racial ideologies.

Last year, the Thrift Savings Plan began allowing federal employees to invest their taxpayer funded salaries into ESG plans.

The U.S. Government has no business propping up woke scams like ESG. Congress should eradicate every federal policy and office that promotes it, starting here.

Lee said in a statement:

This vital piece of legislation fights back against the destructive influence of ESG investing. This investing scheme, championed by woke corporations and facilitated by the Biden Administration, aims to undermine reliable American energy and advance radical ideologies, including the Administration’s political agenda. It is unacceptable for taxpayer funds to be channeled into these woke scams. Congress must take a stand and eliminate federal policies that promote this detrimental agenda. Together, we can protect our energy sector, reject divisive ideologies, and ensure the financial well-being of hardworking Americans.

What Would the No ESG at TSP Act Do?

The bill “would prohibit the TSP from allowing federal employees to invest their taxpayer-funded salaries into funds that make biased investment decisions based on ESG criteria,” as noted in a press release about the bill.

Roy’s press release also states, “ESG investing poses a dangerous threat to the free flow of capital. The movement is actively threatening our domestic energy supply, empowering activist shareholders, and advancing woke gender and racial ideologies.”

The legislation would require the TSP to develop a process to identify and remove any funds currently included among TSP’s investment options that are marketed as making investment decisions based on ESG criteria. This would apply to the new mutual fund window (MFW) as well.

If the bill were to become law as written, TSP participants who owned any of the blacklisted ESG funds would be notified by the TSP and would then have the opportunity to reinvest their assets into other funds. If they failed to do so, the TSP would reallocate the assets in question to the G Fund.

The legislation also allows TSP participants or beneficiaries to bring a civil suit against the TSP if it violates the act. This provision is included to ensure accountability and protection of taxpayer funds.

What Funds Would Be Excluded by the Bill?

These are the criteria the legislation would use to determine which funds to exclude from the list of TSP investments:

- Environmental criteria, including:

- Emissions, climate change, sustainability, environmental justice, pollution, or conservation; or

- Whether a company is engaged in the exploration, production, utilization, transportation, sale, or manufacturing of fossil fuel-based energy.

- Social criteria, including:

- Diversity criteria, including:

- The sex, race, ethnicity, gender identity, sexual orientation, or socioeconomic status of the owners, board members, employees, or customers of companies; or

- Whether the board members, employees, or customers described in item (aa) are members of a labor organization (as that term is defined in section 2 of the National Labor Relations Act (29 U.S.C. 152)); or

- Whether a company is engaged in the manufacture, transportation, or sale of firearms, firearms accessories, or ammunition.

- Diversity criteria, including:

- Political criteria, including the perceived or actual political affiliations, donations, or associations of companies.

- Criteria for corporate governance standards that differ from the applicable standards required under State and Federal law, as in effect on the date of the enactment of this subparagraph.

What is Environmental, Social, and Governance (ESG) Investing?

Investopedia.com defines ESG investing as follows:

Environmental, social, and governance (ESG) investing refers to a set of standards for a company’s behavior used by socially conscious investors to screen potential investments.

Environmental criteria consider how a company safeguards the environment, including corporate policies addressing climate change, for example. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Controversy Surrounding the Mutual Fund Window

The mutual fund window has been a source of controversy among some lawmakers since it launched a year ago.

In addition to the ESG concerns, other lawmakers have targeted it because of national security concerns. Some Senators sought to cancel the mutual fund window before it launched due to the potential for allowing investments into Chinese companies that pose a direct threat to national security.

The Federal Retirement Thrift Investment Board (FRTIB) said at the time that it would not be able to monitor the mutual fund window for any of the blacklisted Chinese companies because it “would prove to costly for the plan.” The FRTIB would probably have the same reaction to the No ESG at TSP Act.

The mutual fund window has also been criticized for its high fees and for limiting total investments to 25% of one’s total TSP portfolio.

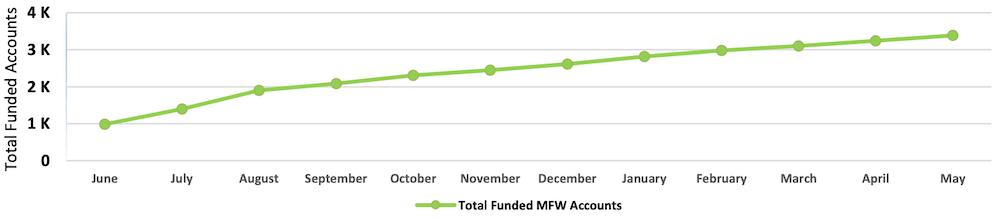

The number of federal employees using the mutual fund window has been low relative to the size of the TSP as a whole; as of May 2023, approximately 3,300 MFW accounts have been established. The FRTIB has said in the past though that MFW adoption rate was in line with its expectations.