Announcements of Interest at Monthly TSP Meeting

In the monthly meeting of the Federal Retirement Thrift Investment Board (FRTIB), it was announced that the dollar amount used to purchase annuities is about the same as the total that participants put into annuities during all of 2022. This is likely due to an increase in the annuity interest rate index.

An annuity interest rate index is an index used to determine the interest rate paid on an indexed annuity. An indexed annuity is an annuity contract that pays an interest rate based on the performance of a specified market index. As the rate paid is going up, more annuities are being purchased.

What is a Hardship Withdrawal?

Hardship withdrawals for May and June are the highest they have been since August 2022.

A hardship withdrawal from the TSP is a withdrawal available to federal civilian employees and members of the uniformed services experiencing financial hardship. To qualify, the participant must have an immediate and significant financial need necessitating a distribution from their TSP account. The need must arise out of either a recurring negative monthly cash flow situation, medical expenses, legal expenses for separation or divorce, or personal casualty loss.

There are consequences for taking a hardship withdrawal from the TSP.

- It is a permanent withdrawal from an investor’s TSP account. The investor cannot put the money back.

- A withdrawal reduces the amount of money that grows and generates compound earnings.

- The TSP will withhold 10% on the taxable portion of the withdrawal for federal income tax. An investor withdrawing the money in this way has the option of changing the withholding to any percentage, including reducing the amount to 0%.

- The taxable portion of the withdrawal is subject to federal income tax at the investor’s ordinary rate. Also, the withdrawal may create an obligation to pay state income tax.

- If the investor is a FERS employees or a uniformed services member, a financial hardship withdrawal requires the consent of the spouse.

- If the investor is a CSRS employee, a financial hardship withdrawal requires spousal notification.

Positive TSP Performance in 2023; Beware of Rosy Predictions

Your Thrift Savings Plan (TSP) performance so far in 2023 has exceeded the expectations of many investors. The C, S, and I core TSP stock funds are all showing significant gains this year as demonstrated in the chart below.

The S&P 500 (the index on which the TSP C Fund is based) is up 19% this year despite analysts’ predictions that 2023 corporate earnings are unlikely to go up. According to the Wall Street Journal, the S&P 500 index is up about 27% from its most recent bottom.

According to a Vanguard survey, investors last June said they expected U.S. stocks to return 5.5% in the next 12 months.

This latest survey is their most bullish forecast since the 2022 bear market and the highest forecast since the 6% return that was forecasted for stocks in December 2021.

A word of warning for those that like to trade stocks based on the latest predictions. That 6% bullish forecast for stocks was about one month before the S&P 500 index hit a new record high in January 2022. That was a good start after the prediction had been made for new stock market records, but contrary to the rosy predictions, the index started to fall, and the C Fund dropped more than 18% in 2022.

Here is another point to caution optimistic investors.

Since the early 1950s, every episode of significant U.S. disinflation, each of which was driven at least partly by Fed tightening, has been accompanied by recession….That has been bad news for stocks: In recessions since the late 1940s, the S&P 500 has fallen a median of 24%, (according to Deutsche Bank research).

Stock Market Shrugs Off Recession Signals as Rally Builds – WSJ

Last week, the S&P 500 traded at 19.6 times its projected earnings over the next 12 months. The 10-year average for this index is 17.7. The valuation for stocks may continue to go higher or continue to stay at the current high level. High optimism in stocks continuing to go up, as indicated by the Vanguard investors survey cited above, is inviting risky investing in the stock market.

2023 TSP Performance So Far in July and the Year-to-Date

| Fund | Month-t0-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.26% | 2.18% |

| F Fund | 0.09% | 2.34% |

| C Fund | 2.41% | 19.69% |

| S Fund | 4.07% | 17.23% |

| I Fund | 1.87% | 14.25% |

| L Income | 0.81% | 5.89% |

| L 2025 | 1.05% | 7.87% |

| L 2030 | 1.58% | 11.32% |

| L 2035 | 1.70% | 12.22% |

| L 2040 | 1.83% | 13.13% |

| L 2045 | 1.94% | 13.91% |

| L 2050 | 2.05% | 14.69% |

| L 2055 | 2.44% | 17.40% |

| L 2060 | 2.44% | 17.39% |

| L 2065 | 2.44% | 17.40% |

C Fund Becomes Largest TSP Fund Again

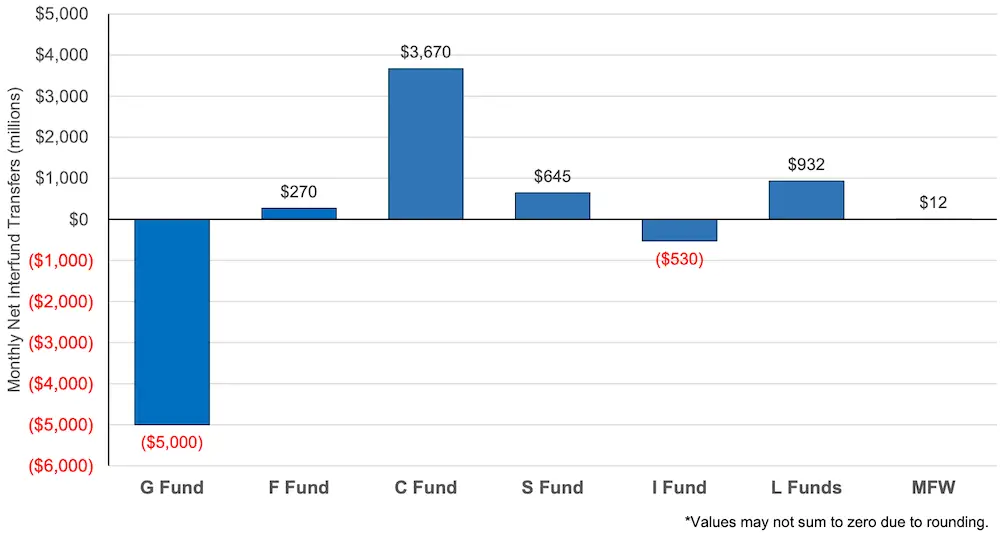

Last month, TSP investors received a good return on their investments. Perhaps those returns encouraged those that like to make interfund transfers during a month to withdraw money from the G Fund.

In June, about $5 billion was withdrawn from the G Fund and $530 million was withdrawn from the I Fund. More than $3.6 billion was transferred into the C Fund, $645 million into the S Fund, and $932 million into the L Funds.

While this is a great deal of money, there is now $796 billion in assets in the TSP as of June 30th. As noted in the monthly meeting on the TSP, the transfers represent about 2.1% of participants moving funds in the month.

While the percentage of transfers is small in any given month, the C Fund is again the largest fund for participant allocations in the TSP. As of June 30, 2023, 30.9% of participant TSP allocations are in the C Fund. The G Fund has moved back into second place with 29.8% of these assets.

While the C Fund was the largest fund after the bullish stock market, the G Fund became the largest fund during the bear market in stocks. Presumably, TSP investors did not like seeing their investment total declining and moved into the safety of the G Fund while the market was tanking. The downside of this is that once the money is moved out of the stock funds, the G Fund provides a lower return when stocks start going back up. Knowing when to move in or out of the market requires guessing correctly as to when to sell and when to buy a stock fund. That is impossible to do with perfection but human nature dictates that many will try this approach.