At the end of 2022, TSP investors were probably unhappy with the latest returns. It was the worst year for these returns since 2008. All TSP funds were down last year except for the G Fund.

Here is how TSP Funds fared last year.

2022 TSP Fund Performance

| G Fund | 2.98% | F Fund | -12.83% | C Fund | -18.13% |

| S Fund | -26.26% | I Fund | -13.94% | L Income | -2.70% |

| L 2025 | -6.72% | L 2030 | -10.32% | L 2035 | -11.65% |

| L 2040 | -12.90% | L 2045 | -14.03% | L 2050 | -15.05% |

| L 2055 | -17.60% | L 2060 | -17.61% | L 2065 | -17.62% |

Merry Christmas from the TSP!

What a difference a year makes. It is starting to look like Christmas on Wall Street with the stock market going up fast and setting new records.

The stock market is rolling again. After three months of stocks declining, TSP fund performance jumped in November when U.S. stocks had their best month in more than a year. The S&P 500 index, on which the C Fund is based, was up 8.9% in November and 9.12% for the month.

Despite the volatility, the Dow Jones Industrial Average vaulted to a new record high on December 13, 2024. The previous high was on January 4, 2022. This stock market average dropped 22% to its low in September 2022 before going higher again and setting at least one new record.

With the Federal Reserve now projecting more interest rate cuts than expected in 2024, other stock market sectors are also moving up.

Did You “Buy and Hold” or Sell Stocks in a Down Market?

The stock market is now a “bull market” based on rising stocks over the last two months. For any federal employees planning on retiring, the additional value of their TSP investments will be a welcome sight.

This is good news for TSP investors, with the C Fund now up 24.50% so far this year and the S Fund up 20.86% this year. The G Fund is again the lowest-performing fund, as is often the case when stock prices ratchet up, as is happening now.

The advantage of the G Fund is that it provides stability in an investment portfolio. When stocks go down, as they always do, the G Fund has always gone up.

Over time, those who become stock market millionaires probably have most of their investments in TSP’s core stock funds and not the G Fund. While stocks decline in a down market, they often go up more than they dropped in a bear market.

Holding on to stocks in a bear market can be difficult as investors see their total investment continuing to drop in value. Historically, that has paid off for those who have the financial resources and the internal fortitude to hang in and avoid the latest bad news shouted by headlines.

2023 TSP Returns for All TSP Funds: Month and Year-to-Date

| Fund | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.16% | 3.99% |

| F Fund | 2.51% | 4.35% |

| C Fund | 3.09% | 24.50% |

| S Fund | 6.54% | 20.86% |

| I Fund | 2.57% | 15.22% |

| L Income | 1.09% | 8.16% |

| L 2025 | 1.42% | 10.19% |

| L 2030 | 2.22% | 14.11% |

| L 2035 | 2.43% | 15.09% |

| L 2040 | 2.63% | 16.08% |

| L 2045 | 2.81% | 16.92% |

| L 2050 | 2.97% | 17.76% |

| L 2055 | 3.36% | 20.68% |

| L 2060 | 3.37% | 20.68% |

| L 2065 | 3.37% | 20.68% |

Number of TSP Millionaires Will Go Higher

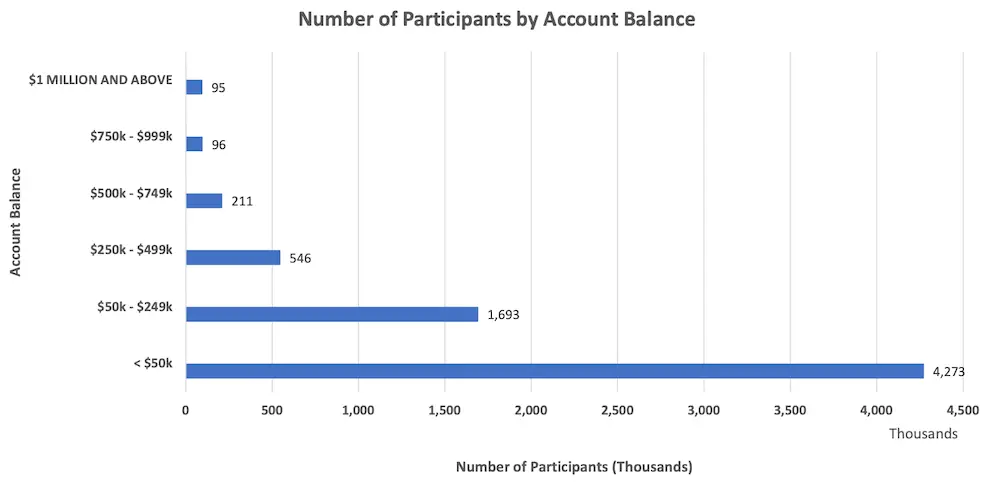

As of December 31, 2021, there were 112,880 millionaires in the federal government’s Thrift Savings Plan (TSP). At last count, on September 30, there were still fewer TSP millionaires than in 2021 as there were 94,873 TSP millionaires as of the end of September 30, 2023.

If the stock market continues to go up through the end of December, the number of these successful investors will go up again—perhaps again nearing the number that existed two years ago.

We hope many FedSmith readers will enjoy the feeling of knowing you have a million or more dollars that can be used in your current or future retirement!