Legislation has been reintroduced for a third time in an effort to hold tax delinquent federal employees accountable for their delinquent tax debt or unfiled tax returns.

The Federal Employees and Retirees with Delinquent Debt Initiative (FERDI) Act (S. 1011), has been reintroduced by Senator Mike Braun (R-IN). Senator Joni Ernst (R-IA) is a co-sponsor.

The legislation would bar federal employees with significant unpaid tax liability from employment with the federal government. However, federal employees or applicants working to settle their tax debt and resolve outstanding liabilities would be exempt. The bill also provides a financial hardship exemption if the individual’s service is in the best interests of the United States.

Ernst said in a recent statement:

While Iowans sat down at the kitchen table to complete their tax forms before the filing deadline this past week, thousands of federal employees whose salaries are paid by those taxes did not bother.

That’s right, while you’re paying taxes and working to make ends meet, many federal employees—some making over $100,000 a year—are serial tax evaders. More than 1,200 IRS employees, including tax collectors, were delinquent in paying their own tax bills.

While the Biden administration is hiring over 87,000 new employees, including an army of auditors at the IRS, they can’t even get their current employees to follow the law and aren’t doing much to try. That’s why, at my request, the Inspector General has agreed to conduct an audit of the IRS to investigate the fraudsters within their own agency.

Report: There is Little Accountability for Tax Delinquent Federal Employees

Some of the information Ernst is referring to comes from a recent report released by the U.S. Treasury Inspector General For Tax Administration (TIGTA) which found that the Internal Revenue Service (IRS) rarely holds federal employees accountable for failing to file or pay their taxes. The IRS also devotes very little time to its efforts to do so.

The FERDI Act is not new legislation (it was last introduced in 2021), but TIGTA’s report only reinforced the Senators’ desire to see it passed, so it is probably not a coincidence that the bill was reintroduced shortly after the report was released.

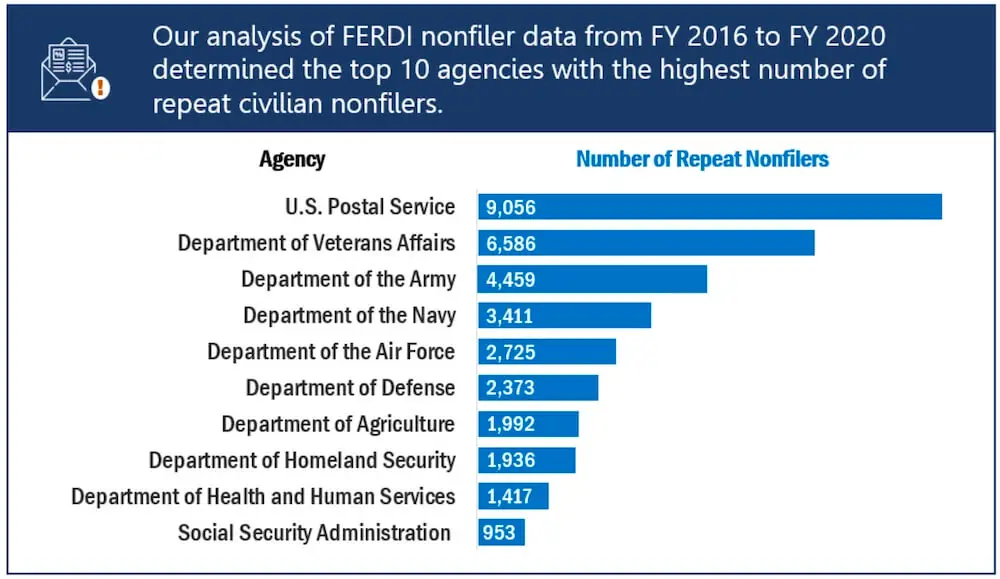

The TIGTA report also showed that there are now over 42,000 federal employees that have repeatedly failed to file a tax return for multiple years in the time period TIGTA analyzed. In some cases, it is occurred for 9 years or more.

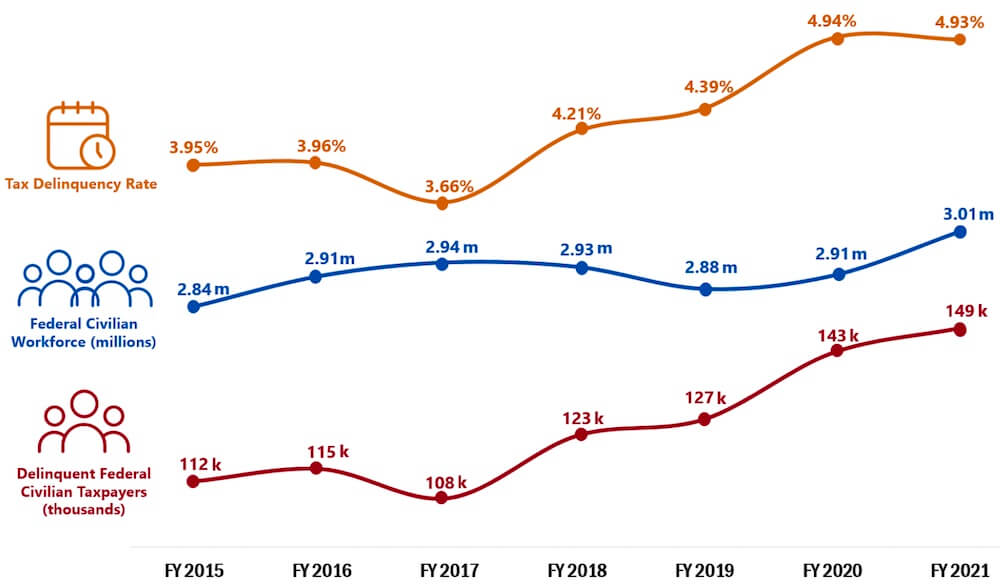

The number of tax delinquent federal employees has also grown considerably since fiscal year 2015. The image below from the report depicts the growth.

According to the TIGTA report, the Postal Service, Department of Veterans Affairs, Army and Navy were among the agencies with the highest numbers of repeat non-filers, i.e. the federal employees who continued not to file their tax returns in multiple years.

For more information, see IRS Rarely Punishes Tax Delinquent Federal Employees.

What is the Penalty For Not Filing Your Taxes?

According to the IRS, the Failure to File Penalty applies if an individual does not file his or her tax return by the due date. A penalty must be paid that is a percentage of the taxes that were not paid on time. The penalty is calculated based on how late the tax return is filed and based on the amount of unpaid tax as of the original payment due date (not the extension due date).

The IRS states:

We calculate the Failure to File Penalty in this way:

- The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

- If both a Failure to File and a Failure to Pay Penalty are applied in the same month, the Failure to File Penalty is reduced by the amount of the Failure to Pay Penalty for that month, for a combined penalty of 5% for each month or part of a month that your return was late.

- If after 5 months you still haven’t paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

- If your return was over 60 days late, the minimum Failure to File Penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax required to be shown on the return, whichever is less.

What is the FERDI Program?

The acronym in the bill’s name is based off of the Federal Employee/Retiree Delinquency Initiative (FERDI) which was established by the IRS to promote Federal tax compliance among current and retired Federal civilian and military employees.

According to the IRS, “The goal of the FERDI program is to reduce Federal employee and retiree tax delinquency through collection policy and procedures…”

The IRS further adds:

The FERDI program was developed in 1993 to promote federal tax compliance among current and retired federal employees. The program incorporates the purpose and intent of Office of Government Ethics regulation 5 CFR Part 2635.809 which addresses the responsibility of federal employees to “satisfy in good faith their obligations as citizens, including all just financial obligations, especially those such as federal, state or local taxes that are imposed by law”.